This Non-Bank Lender/Specialty Finance Leader Has Seen Exponential Growth With a Record Year in 2021!

Mill City Ventures III, Ltd. (NASDAQ: MCVT) is a non-bank lender and specialty finance company dedicated to helping companies and individual investors.

Download Research Report

Mill City Ventures III, Ltd. (NASDAQ: MCVT) recently reported incredible financial growth making this specialty finance company one to keep your eye on!

Inflation is the highest it has been since 1981 sitting at a whopping 9.1% as of June 2022.

This, as with rising costs due to supply chain issues, has driven many Americans into non-bank lending and specialty finance. In fact, 68% of all mortgages in 2020 came from non-bank lenders.

Independent non-bank lenders are playing an increasingly important role in the global economy by providing funding where banks are less keen.

This brings us to Mill City Ventures III, Ltd. (NASDAQ: MCVT), a small cap company on the NASDAQ dedicated to helping companies and individuals with their refinancing needs.

MCVT is proving to be an exciting company to keep your eye on as the company has reported exponential financial growth in 2021.

The company’s recent quarter results showed that interest income from lending operations increased 83% to $1M compared to $546k for the prior-year period as well as pre-tax earnings from lending operations increased in the prior-year period.

High-Net-Worth individuals and companies come to MCVT because of much faster turn-around time to closing versus traditional banks.

MCVT also has a relatively low trading float, reported recently at 2.5 million shares, making this small cap company worth watching!

Specialty financing is becoming more popular now than ever as the traditional banking system and capital markets are less receptive to lending to niche segments of specialty finance, which creates an exciting opportunity for companies like MCVT to step in.

Investors are increasingly drawn to this market due to strong risk-adjusted returns and high cash yields.

"We have achieved our ninth record quarter for both income and earnings from our lending operations. We continue to see strong demand for our loan products and have been able thus far to maintain a zero-loss ratio with respect to defaults in our loan portfolio .With the establishment of our $5M line of credit in the fourth quarter, we were able to leverage our equity and grow our loan business substantially. Our revenue growth continues to outpace the growth in operational expenses allowing for us to expand our net margins.”

-Chief Executive Officer Douglas M. Polinsky of MCVT

In dire financial times, many High-Net-Worth indivuduals and companies are turning to non-bank lenders more than ever making Mill City Ventures III, Ltd. (NASDAQ: MCVT) an exciting small-cap company to keep your eye on as it continues to show impressive growth!

Now is the time to be paying attention to Mill City Ventures III, Ltd. (NASDAQ: MCVT) as they are rising to the top of the exciting, specialty finance market!

Earlier this year, MCVT announced its funding of a pre-closing to the sale of a 350-unit apartment complex. The company advanced $3.9 million in the form of a short-term note. Subsequently, this note has been paid back, and MCVT's annualized return equaled 32%

This investment represented the largest single investment in company history!

"With the recent closing of our credit facility, we are now in a position to expand the size of our funding opportunities. We have seen an increase in deal flow and continue to pursue investment opportunities in adjudicated insurance settlements, asset-based loans, real-estate-backed loans, and equity investment opportunities."

MCVT’s Chief Executive Officer, Douglas M. Polinsky

Non-bank lending has seen recent growth as more consumers and small businesses are turning to non-traditional financing.

According to Oracle’s Digital Demand in Retail Banking study of 5,200 consumers from 13 countries, over 40% of customers surveyed think nonbanks can better assist them with personal money management and investment needs, and 30% of respondents who haven’t tried a nonbank platform said they’re open to trying one!

According to data reported by SME Finance Forum, in 2018 there was funding gap of $5 trillion between the financing needs of small and medium businesses and the institution-based financing available to them causing small businesses to seek alternative funding options.

All of this points to Mill City Ventures III, Ltd. (NASDAQ: MCVT) as an exciting small-cap company quickly rising to the top of the specialty finance sector!

Inflation is the highest it has been since 1981 sitting at a whopping 9.1% as of June 2022, making many consumers and small businesses look for alternative finance options in dire times driving more attention to companies like MCVT.

MCVT has seen incredible revenue growth, making the company exciting to keep an eye on. The company’s recent quarter results showed that interest income from lending operations increased 83% to $1M compared to $546k for the prior-year period as well as pre-tax earnings from lending operations increased to $454k compared to $12k in the prior-year period.

Earlier this year, MCVT announced its funding of a pre-closing to the sale of a 350-unit apartment complex. The company advanced $3.9 million in the form of a short-term note. Subsequently, this note has been paid back, and MCVT's annualized return equaled 32% This investment represented the largest single investment in company history!

According to recent surveys, over 40% of customers surveyed think nonbanks can better assist them with personal money management and investment needs bringing more attention to non-traditional lenders.

With rising inflation due to effects of the pandemic, growing gas prices, and supply chain issues driving costs, non-bank lending has increased exponentially! Issuance of asset-backed securities increased by 16.3% to $73.5 billion in Q2 2021, up from $63.3 billion in Q1 2021.

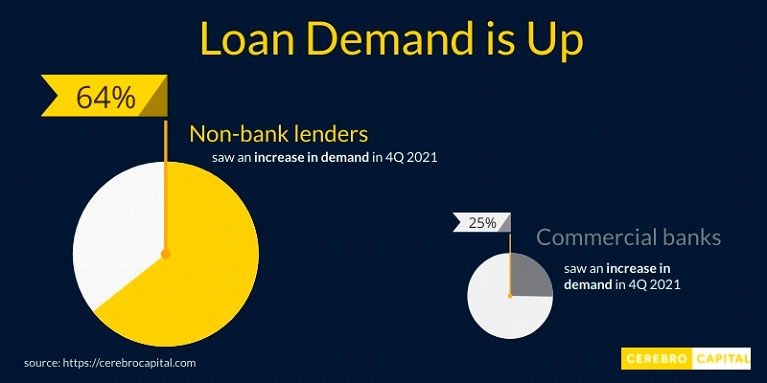

Non-bank lenders have seen a 64% increase in demand while commercial banks only saw a 25% increase in demand! This goes to show many consumers and small businesses are rejecting traditional forms of financing and turning to companies like MCVT for their lending needs.

With rising interest in non-bank lending, Mill City Ventures III, Ltd. (NASDAQ: MCVT) is quickly becoming a leader in the specialty finance sector!

Mill City Ventures III, Ltd. (NASDAQ: MCVT). was founded in January, 2006 and is based in Wayzata, Minnesota.

MCVT is a non-bank lender/specialty finance firm specializing investments in debt and equity securities of public and private companies to fund their operations whether its start-up, acquisition, or growth.

The company’s mission is to please both their borrowers and, most importantly, their stakeholders. They loan to private companies. The company brings the financing necessary for borrowers to fund their operations whether it’s real estate bridge mortgages and loans, cash for operations or general purpose loans with sufficient collateral.

MCVT’s goal is to achieve above market returns for their investors while working diligently to mitigate investor risk. The company management has the unique ability to please both of these interested parties.

CASE STUDY:

MCVT earlier this year, announced its funding of a $3.4 million short-term loan to facilitate the acquisition of a parcel of land located in Glendale, AZ, where 139 townhouse units are expected to be developed.

The short-term note is expected to generate a minimum annualized return of 53% to Mill City.

MCVT has seen an increase in demand of funding opportunities since the beginning of 2022, and continues to pursue transactions in adjudicated insurance settlements, asset-based loans, real estate backed loans, and equity investment opportunities.

"This investment represents our first foray into the red hot greater Phoenix multi-unit housing market. Our streamlined underwriting process allowed us to get involved in this transaction late in the game and still meet the closing deadline for this promising townhome development project."

MCVT CEO Douglas M. Polinsk

THE BOTTOM LINE

Mill City Ventures III, Ltd. (NASDAQ: MCVT) is a non-bank lender and specialty finance company dedicated to helping companies and high net-worth individuals.

Inflation has driven many Americans into non-bank lending and specialty finance, in fact 68% of all mortgages in 2020 came from non-bank lenders and non-bank lenders have seen 64% of growth in interest from small companies and consumers alike.

MCVT has seen incredible revenue growth with 2021 being a record breaking year for the company. In 2022, the company has been reporting exciting quarter revenue growth as well.

MCVT’s goal is to achieve above market returns for their investors while working diligently to mitigate investor risk.

All of this points to Mill City Ventures III, Ltd. (NASDAQ: MCVT) as an exciting, small-cap company that is sure to dominate the growing specialty finance sector!

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

This website is wholly owned by scd media llc (d/b/a “smallcapsdaily.com”). Our reports are advertorials and are for general information purposes only. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. This disclaimer is to be read and fully understood before using our services, joining our email list, as well as any social networking platforms we may use. Please note as well: Small Caps Daily and its employees are not Registered Investment Advisors, broker-dealers, or member(s) of any association for other research providers in any jurisdiction whatsoever. release of liability: through use of this website, viewing or using you agree to hold Small Caps Daily, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Small Caps Daily encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the company profiled or is available from public sources and Small Caps Daily makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Small Caps Daily strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Small Caps Daily’s full disclosure is to be read and fully understood before using Small Caps Daily's website, or joining Small Caps Daily's email or text list. From time to time, Small Caps Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing Small Caps Daily's website and/or reading Small Caps Daily's email or text newsletter you are agreeing to this ----> https://smallcapsdaily.com/disclaimer/. All potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation. In compliance with section 17(b) of the securities act we are disclosing that we have been compensated a fee pursuant to an agreement between scd media llc and sea path advisory. Small Caps Daily was hired for a period beginning July 2022 and ending October 2022 to publicly disseminate information about Mill City Ventures III, Ltd. via website, email, and sms. We were paid five thousand usd via ACH. We are also disclosing that Tradigital Marketing Group has been compensated a fee pursuant to an agreement between Tradigital and Mill City Ventures III, Ltd. Tradigital was hired for a period beginning July 2022 and ending October 2022 to publicly disseminate information about Mill City Ventures III, Ltd., via website, email, and SMS. Tradigital was paid four hundred forty-five thousand USD via ACH. Subsequently, Tradigital was paid one hundred thousand USD via ACH. Tradigital owns one hundred fifty thousand restricted common shares of Mill City Ventures III, Ltd., which are eligible for sale on 02/06/2023. For the purpose of this disclaimer, we suggest that you assume we will sell all of our shares once the restriction is lifted on 02/06/2023. Readers are advised to review sec periodic reports: forms 10-q, 10k, form 8-k, insider reports, forms 3, 4, 5 schedule 13d. Small Caps Daily is compliant with the can-spam act of 2003. Small Caps Daily does not offer investment advice or analysis, and Small Caps Daily further urges you to consult your own independent tax, business, financial, and investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. it is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled.the private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact may be forward-looking statements. forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. understand there is no guarantee past performance will be indicative of future results in preparing this publication, Small Caps Daily has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. the advertisements in this website are believed to be reliable, however, Small Caps Daily and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Small Caps Daily is not responsible for any claims made by the companies advertised herein, nor is Small Caps Daily responsible for any other promotional firm, its program, or its structure. Small Caps Daily is not affiliated with any exchange, electronic quotation system, the securities exchange commission, or finra.