Georgia, Inland Waterways, National Category

Startup Uses Drone for Cleaning Water, Collecting Data

Our nation’s drinking water infrastructure system is made up of 2.2 million miles of underground pipes that deliver safe, reliable water to millions of people. Unfortunately, the system is aging and underfunded. There is a water main break every two minutes and an estimated 6 billion gallons of treated water lost each day in the U.S. enough to fill over 9,000 swimming pools. However, there are signs of progress as federal financing programs expand and water utilities raise rates to reinvest in their networks. It is estimated that more than 12,000 miles of water pipes were planned to be replaced by drinking water utilities across the country in the year 2020 alone. In 2019, about a third of all utilities had a robust asset management program in place to help prioritize their capital and operations/maintenance investments, which is an increase from 20% in 2016. Finally, water utilities are improving their resilience by developing and updating risk assessments and emergency response plans, as well as deploying innovative water technologies like sensors and smart water quality monitoring.

Download Report

drinking water infrastructure is composed of

2.2 million miles of pipe

utilities were replacing between 1% and 4.8% of their pipelines

per year on average

that more than 12,000 miles of water pipes were planned to be replaced by drinking water utilities

across the country in 2020

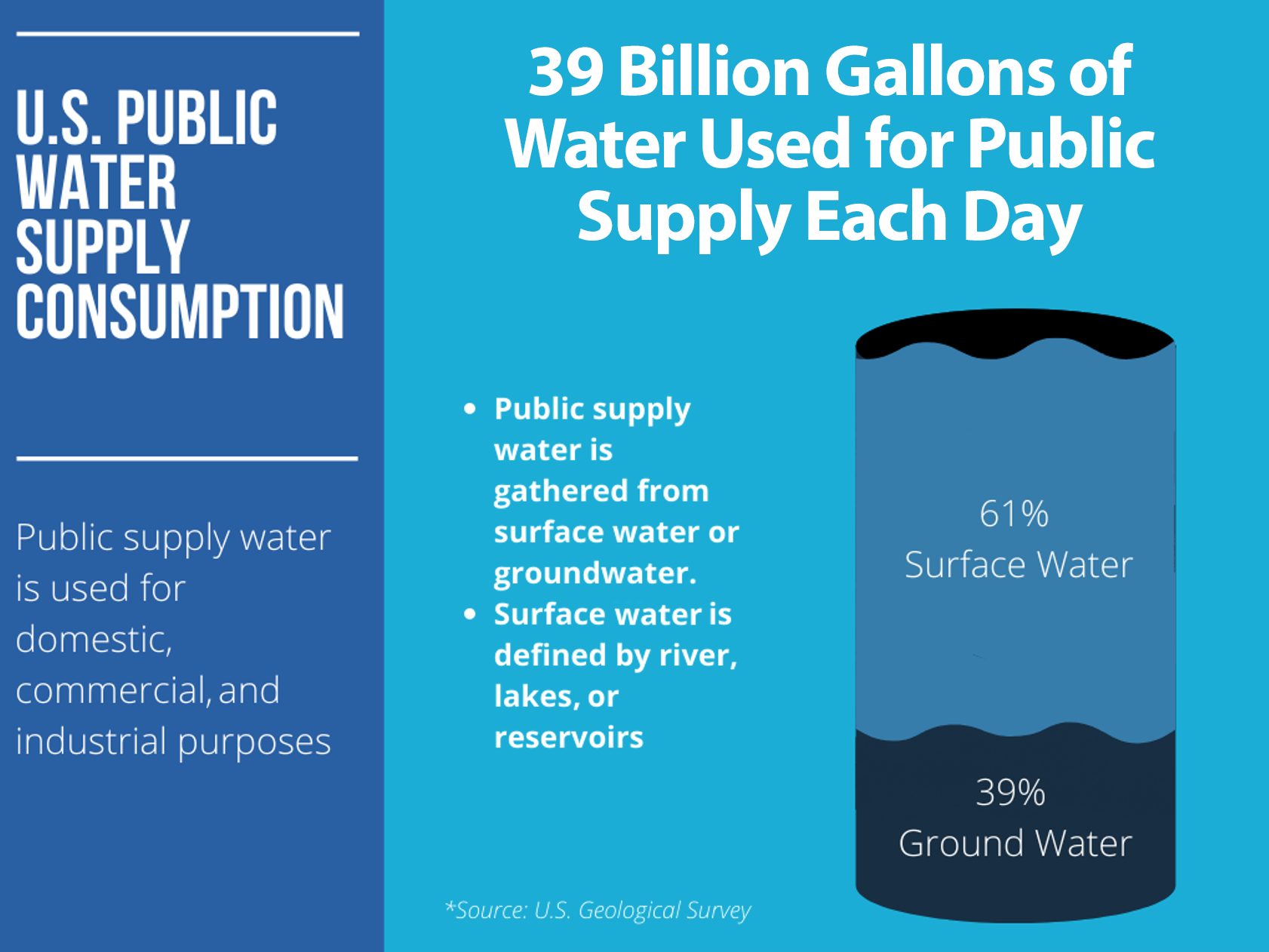

Access to clean and safe drinking water is critical to public health and economic prosperity and, on average, people use around 82 gallons of water per person, per day in the United States. Nearly half of water utilities report declining or flat total water sales in the past 10 years, largely due to efficiency improvements. Water usage dropped 3% from 2010 to 2015, despite a 4% increase in the nation’s total population. Due to declining water usage, there is currently adequate drinking water capacity in the U.S. About 39 billion gallons of water a day are withdrawn from surface water or groundwater sources for public supply. Public supply use represents about 12% of total freshwater withdrawals.

Funding for drinking water infrastructure has not kept pace with the growing need to address aging infrastructure systems, and current funding sources do not meet the total needs. In general, however, state and local governments have invested more than their federal counterparts. Despite the growing need for drinking water infrastructure, the federal government’s share of capital spending in the water sector fell from 63% in 1977 to 9% of total capital spending in 2017. On average, about two-thirds of public spending for capital investment in water infrastructure since the 1980s has been made by state and local governments.

The DWSRF provides low-interest loans to state and local drinking water infrastructure projects. It has continued to receive increased federal appropriations since Fiscal Year (FY) 2017.

Decades old drinking water infrastructure systems, declining water use, costs of regulatory compliance, and stagnant federal funding has resulted in many water utilities struggling to fund the cost of operations and maintenance of these systems.

Our nation’s drinking water systems face staggering public investment needs over the next several decades. ASCE’s 2020 economic study, “The Economic Benefits of Investing in Water Infrastructure: How a Failure to Act Would Affect the U.S. Economic Recovery” found that the annual drinking water and wastewater investment gap will grow to $434 billion by 2029. Additionally, the cost to comply with the EPA’s 2019 Lead and Copper Rule is estimated at between $130 million and $286 million. Drinking water utilities also face increasing workforce challenges. Much of the current drinking water workforce is expected to retire in the coming decade, taking their institutional knowledge along with them. Between 2016 and 2026, an estimated 10.6% of water sector workers will retire or transfer each year, with some utilities expecting as much as half of their staff to retire in the next five to 10 years.

Since 1974, the EPA has regulated the nation’s public drinking water supply through the Safe Drinking Water Act (SDWA). The EPA sets national health-based standards and determines the enforceable maximum levels for contaminants in drinking water. All water suppliers are required to notify consumers upon learning of a serious water quality problem, and states and the EPA are required to prepare annual summary reports of water system compliance that must be made available to the public. In 2019, the number of public water systems with health-based violations was 15% lower than in 2017, and public water systems that were returned to SDWA compliance increased nearly 7% compared to 2017.

As the nation faces more frequent extreme weather events, water utilities are taking action to increase the resilience of their systems to ensure safety and reliability. In fact, a 2019 survey found that emergency preparedness is one of the top 10 issues facing the water industry. The America’s Water Infrastructure Act of 2018 required community water systems serving more than 3,300 people to develop or update risk assessments and emergency response plans (ERPs). The law sets deadlines, all before December 2021, by which water systems must complete and submit the risk assessment and ERP to the EPA. The law also specifies the components that the risk assessments and ERPs must address.

Utilities are also developing innovative smart water technologies such as leak detection, seismic resilient pipes, smart water quality monitoring, and real time data sensors, just to name a few. These technologies improve resilience by allowing utilities to respond to changing climate conditions, improve efficiency of operations by reducing water losses, and deliver real-time data that allows for interactive decision-making.

Triple the amount of annual appropriations to the Drinking Water State Revolving Fund program and fully fund the Water Infrastructure Finance and Innovation Act program and the U.S. Department of Agriculture Rural Development programs.

Utilities should implement asset management programs, tools, and techniques to evaluate asset condition and risk, and to prioritize capital and O&M decisions; states should provide funding, training, and technical assistance for asset management programs.

Increase utilities’ resilience by integrating smart water technologies such as machine learning software and real time data sensors into drinking water infrastructure systems.

Eliminate the state cap on private activity bonds for water infrastructure projects to bring an estimated $6 billion to $7 billion annually in new private financing.

Increase federal and local support to find, train, and retain the next generation of the drinking water sector workforce to help offset the large number of expected retirements.

Utilities need to conduct revenue forecasting models to determine the necessary rate revenues that reflect the true cost of water that is needed to provide safe, reliable drinking water and more resilient infrastructure.

Develop and fund affordability programs to ensure that low-income and vulnerable communities do not bear a disproportionate burden of rate increases.

Support voluntary partnerships for small community water systems in need.

Arcadis and Bluefield Research, “Demystifying Intelligent Water: Realizing the Value of Change with Advanced Asset Management,” 2019.

American Society of Civil Engineers and the Value of Water Campaign, “The Economic Benefits of Investing in Water Infrastructure: How a Failure to Act Would Affect the U.S. Economic Recovery,” 2020.

American Water Works Association, “2016 State of the Water Industry Report.”

American Water Works Association, “2019 State of the Water Industry Report.”

American Water Works Association, “Utility Benchmarking: Performance Management for Water and Wastewater,” 2018.

Black & Veatch Management Consulting, LLC, 2018-2019 “50 Largest Cities Water & Wastewater Rate Survey,” 2019.

CNT, “The Case for Fixing the Leaks,” 2013.

Congressional Budget Office, “Federal Support for Financing State and Local Transportation and Water Infrastructure,” October 2018.

Congressional Research Service, “Funding for EPA Water Infrastructure: A Fact Sheet,” March 6, 2019.

EBP calculations using Congressional Budget Office, “Federal Support for Financing State and Local Transportation and Water Infrastructure,” October 2018.

Interview with Bluefield Research Group on “Underground Infrastructure: U.S. Water & Wastewater Pipe Network Forecast, 2019-2028,” November 2019.

U.S. Environmental Protection Agency, “Affordability Criteria for Small Drinking Water Systems: An EPA Science Advisory Board Report, a Report by the Environmental Economics Advisory Committee of the EPA Science Advisory,” 2002.

U.S. Environmental Protection Agency, “Drinking Water Infrastructure Needs Survey and Assessment, Sixth Report to Congress,” March 2018.

U.S. Environmental Protection Agency, “Economic Analysis for the Proposed Lead and Copper Rule Revisions,” October 2019.

U.S. Environmental Protection Agency, “WIFIA Program: 2019 Annual Report,” February 2020.

U.S. Environmental Protection Agency Drinking Water Dashboard.

U.S. Environmental Protection Agency, Ground Water and Drinking Water.

U.S. Geological Survey, “Summary of Estimated Water Use in the United States in 2015.”

Utah State University, Buried Structures Laboratory, “Water Main Break Rates in the USA and Canada: A Comprehensive Study,” March 2018