Quant Insight partners with Symphony to empower users with ‘world-first’ macro analytics insights

- Press Release

London and New York. November 30, 2021 – Quant Insight (Qi), a quantitative financial market analytics and asset insights provider, has partnered with Symphony, the leading markets’ infrastructure and technology platform, to offer macro-based insights to Symphony’s global financial community.

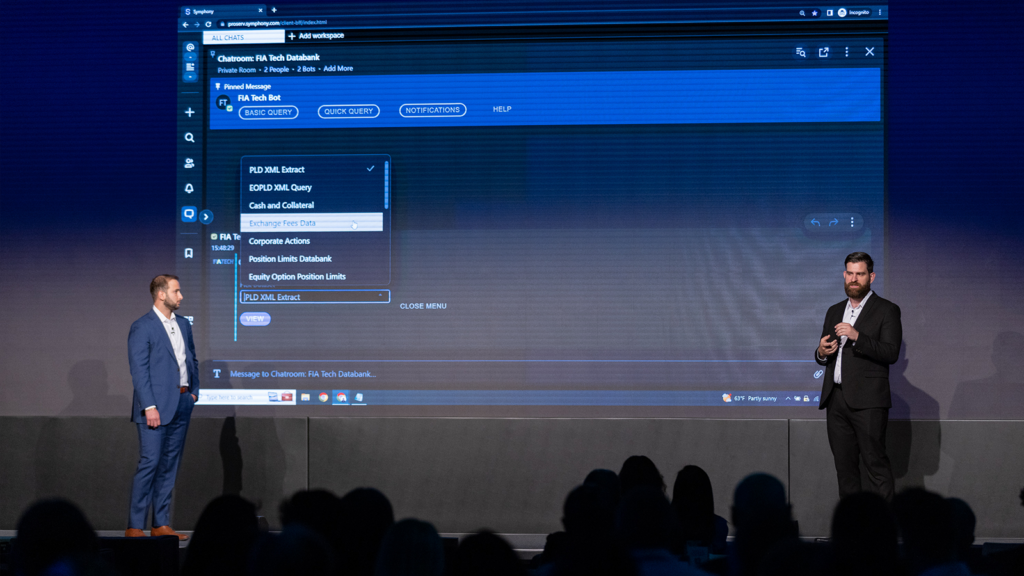

Qi has built a trade BOT, RETINA™ (‘Real time Notifications and Alerts) that will sit on the Symphony platform and push succinct macro-based insights into Symphony chat rooms. Real-time push notification will be tailored to each user based on profile and interests. Users can also ping RETINA to request updated charts for any security. A tracking feature will be released in the coming weeks, which will allow users to track securities of interest in real time and be notified in case of significant shifts.

Qi’s RETINA™ is available on the Symphony Marketplace to Symphony users. With RETINA™, Symphony users will be alerted to macro-based valuation anomalies, shifts in key macro drivers and changes in underlying trends covering 6,000 market instruments including indices, sectors, stocks, FX, rates, futures, commodities, and cryptocurrencies. Updates from the trade BOT will be relevant, timely and sparse, ensuring users are only updated on significant shifts – typically between two and five notifications a day.

The cloud-based financial market brain behind Qi uses state of the art ‘world-first’ machine learning technology and high-quality data inputs including GDP Nowcasts and has been developed in collaboration with world leaders in machine learning (professor Mike Hobson of Cambridge University and professor Ryan Prescott Adams of Princeton University). RETINA reduces millions of publicly-available data points into two to five essential daily insights and is already being used by some of the world’s best known investment banks, hedge funds and asset managers, including Alan Howard of Brevan Howard. RETINA was built by investors for investors. The team includes experienced former portfolio managers from Brevan Howard, Millennium, BlueCrest, Credit Suisse, Morgan Stanley, Fidelity, and others.

“The global financial and markets community is already on Symphony, which makes it the perfect platform for the Quant Insights’ RETINA BOT. In a world of permanent overload of information, professionals truly value technology and developments that will allow them to be effective and efficient, the right information when they need it as they conduct business. RETINA does just that. It will be of great value to the buy-side community”, explained Umesh Patel, global head of strategic alliances and partnerships at Symphony.

Mahmood Nourani, co-founder and CEO for Quant Insight comments: “At Quant Insight, we understand that asset managers are inundated by torrents of information, including news headlines, emails, messages and tweets. Turning this information into actionable knowledge is a major problem. By using scientific and industry proven quant insight tools, RETINA converts information to knowledge in real time and increases transparency to help investors make sound investments and formulate accurate trading strategies.

“Our growing client base of institutional investors and world-renowned hedge funds and asset managers have been universally positive, and this new partnership with Symphony presents a unique opportunity for its platform users to gain cutting-edge insights into the macro-drivers impacting the securities that are of interest to them.”

About Quant Insight

Quant Insight (Qi), a quantitative financial market analytics and insights provider is changing how investment decisions are being made using transparent scientific methodologies and smart machines.

Qi is at the forefront of machine learning and technology, developing the first financial market brain that ingests millions of data points in real time and extracts signal from noise ensuring its clients are ahead of the macro curve.

With offices in London, New York and Limassol, Qi has clients with total Assets Under Management (AUM) of over $2.5 trillion incorporating Qi’s analytics in their investment process.

The company is led by experienced macro hedge fund portfolio managers and leading academics in machine learning and signal extraction from Cambridge, Harvard and Princeton, in addition to best-in-class data engineers with backgrounds from world leading technology firms.

Ilana Zacka

Head of Corporate Communications

Quant Insight

+357 9596 2193 / [email protected]

About Symphony

Symphony is the most secure and compliant markets’ infrastructure and technology platform, where solutions are built or integrated to standardize, automate and innovate financial services workflows. The Symphony platform is a vibrant community of over half a million financial professionals from 500+ market participants with a trusted directory. It is powering over 2,000 community-built applications and bots. The company was founded in 2014 and has raised $510 million from institutional investors.

Odette Maher

Head of Global Communications

Symphony Communication Services

+44 (0) 7747 420807 / [email protected]