Research Summary. It’s likely that you have a Credit card, and maybe you use it every day. After all, the credit card industry is huge, and Americans are incentivized to own at least one. Knowing that, we’ve set out to find all of the latest trends related to credit cards in the U.S., and according to our research:

-

83% of Americans own at least one credit card.

-

There are 1.1 billion credit cards in the U.S. as of 2022

-

The average credit card debt of U.S. families is $6,270.

-

The average American has 3.8 credit cards.

-

41% of consumers prefer to pay with credit cards.

For further analysis, we broke down the data in the following ways:

Credit Card Ownership and Usage | Credit Card Debt | Card Debt Demographics | Credit Card Fraud | Credit Card Companies | Global Credit Card | Other

Credit Card Statistics by Credit Card Ownership and Usage

It’s clear that a majority of Americans own credit cards, and there’s a reason why. Whether you use them to build credit, earn rewards, or because it was what was available to you at the time, credit cards are useful in our everyday lives. For instance, according to our research:

-

34% of Americans have three or more credit cards.

While 83% of Americans own at least one credit card, just over a third actually have three or more. This is because having multiple credit cards allows you to increase your credit limit while also taking a minimal hit to your credit score.

-

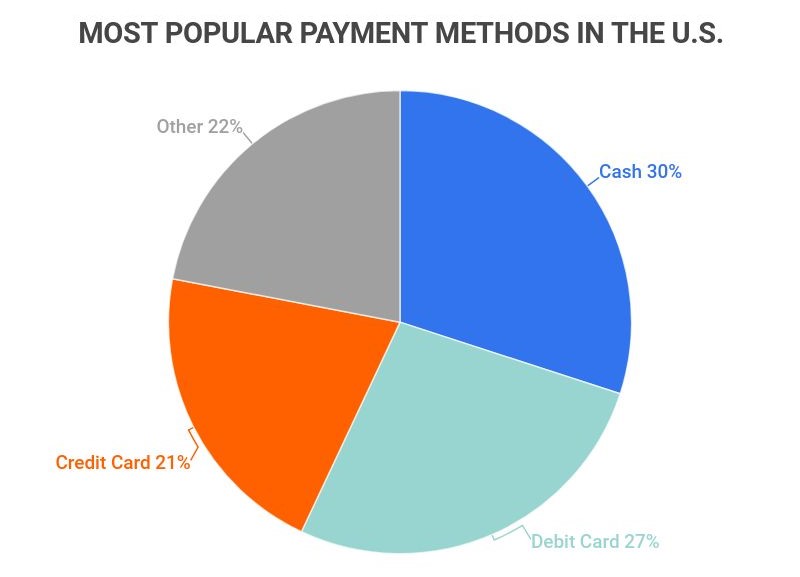

Credit cards make up 21% of all payments in the U.S.

Credit cards are the third most popular payment method in the U.S., just behind cash (30%) and debit cards (27%).

-

82.9% of Americans between the ages of 30-49 own a credit card.

This is the most popular age range for credit card ownership and usage, but credit cards are also popular with those between 50-64 (78.4%) and slightly less popular with those between 18-29 (65.2%).

-

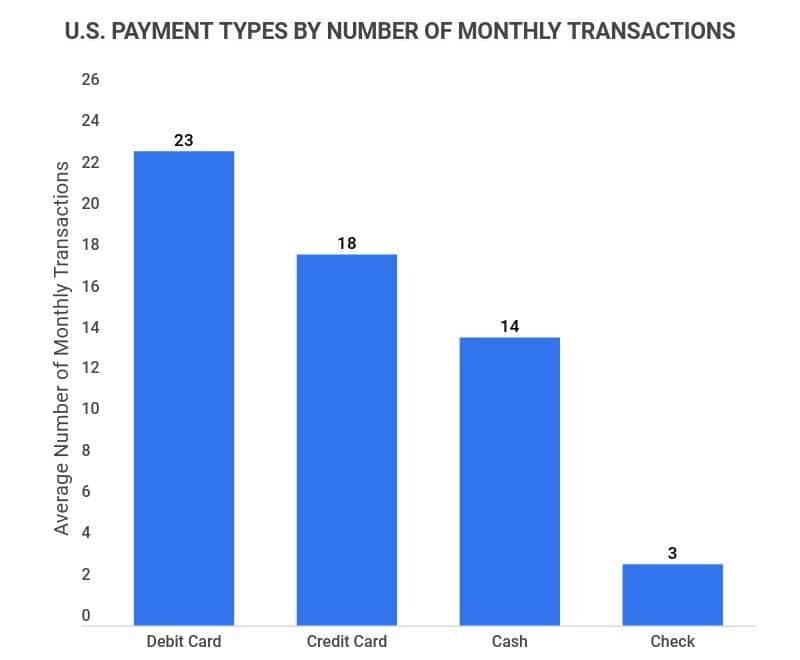

The average credit card user makes 18 credit card transactions per month.

Credit cards have the second-highest use frequency out of all payment types, behind only debit cards (23 transactions per month). Other common American payment types include: cash (14 transactions) and checks (three transactions).

Credit Card Statistics by Credit Card Debt

Unfortunately, credit card use always comes with debt, even if that debt is only temporary. And, seeing as most Americans have a considerable amount of credit card debt, how does it affect our daily lives? Well, here are the facts:

-

As of 2022, total U.S. credit card debt has reached $856 billion.

While that number is already huge, it’s also a 6.5% increase from 2021, when credit card debt reached $804. However, both of these figures are less than when credit card debt reached its all-time peak of $927 billion in 2019, in part, due to the fact that many Americans paid off debt during the height of the COVID-19 Pandemic.

-

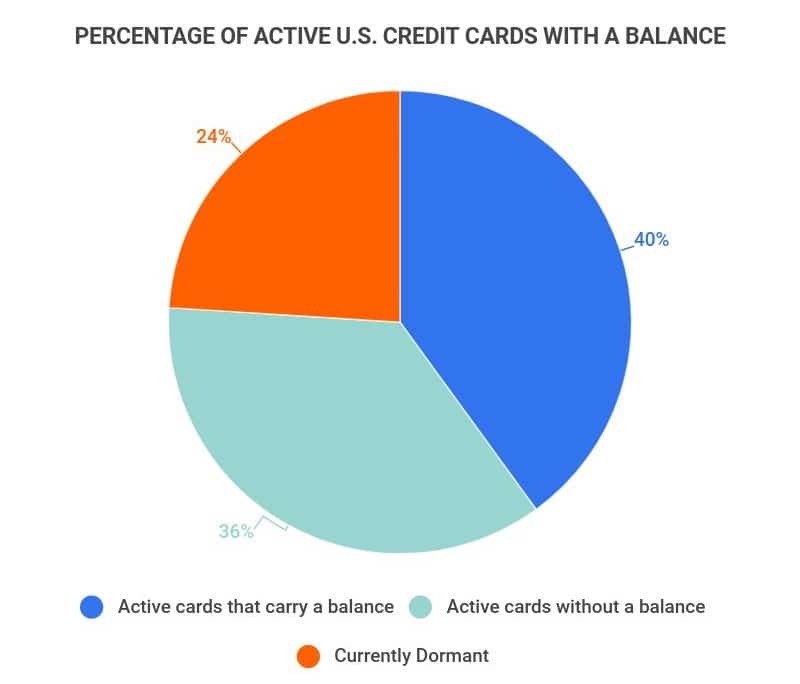

40% of U.S. credit card accounts are active and carry a balance.

The majority of active credit cards in the U.S. carry a balance, as 36% of active accounts don’t carry a balance. Meanwhile, another 24% of accounts are currently dormant.

-

77% of U.S. households have some amount of credit card debt.

Just over three-quarters of U.S. households have credit card debt, compared to only one-quarter who don’t. In fact, 53% of Americans agree that debt reduction is a top priority.

-

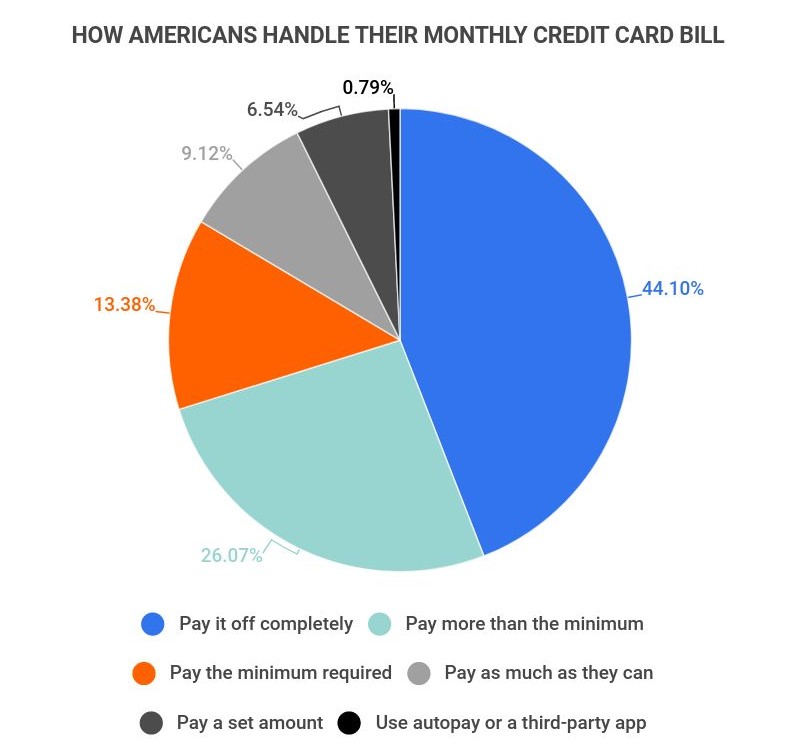

44% of Americans pay off their credit card completely each month.

While this is a decent percentage, it isn’t the majority. Of the 56% who don’t pay off their credit card in full each month, 26.07% pay more than the minimum but never the full balance, 13.38% make only the minimum payment required, 9.12% pay off as much as they can afford, and 6.54% pay a set amount every month.

-

The average credit card debt of U.S. families is $6,270.

However, this number can be skewed by those with very large debts, so it is worth mentioning that the median credit card debt in the U.S. is $2,700.

Credit Card Statistics by Credit Card Debt Demographics

The U.S. is a diverse country, and thus credit card spending and debt are different across different demographics. Location, age, education level, and other factors can all have noticeable effects on how Americans use credit cards. For instance, our research shows that:

-

The average amount of credit card debt for those under 35 is $3,660.

47.6% of those under 35 have credit card debt in the U.S., but this isn’t the most indebted age demographic. Overall, those 45-54 are most likely to have debt, with 51.7% having credit card debt, and the average amount is $7,670. While those 75+ have the most debt on average, with 28% having an average of $8,080 in credit card debt.

Age Average Credit Card Debt Median Credit Card Debt Percent Who Have Debt Under 35 $3,660 $1,900 47.6% 35-44 $5,990 $2,700 50.5% 45-64 $7,670 $3,200 51.7% 55-64 $6,880 $3,000 46.6% 65-74 $7,030 $2,850 41.1% 75+ $8,080 $2,700 28.0% -

Credit card debt among married adults is 41% higher than single adults.

The average amount of credit card debt among U.S. married adults is $6,881, while the average amount of debt for single U.S. adults is only $4,870.

-

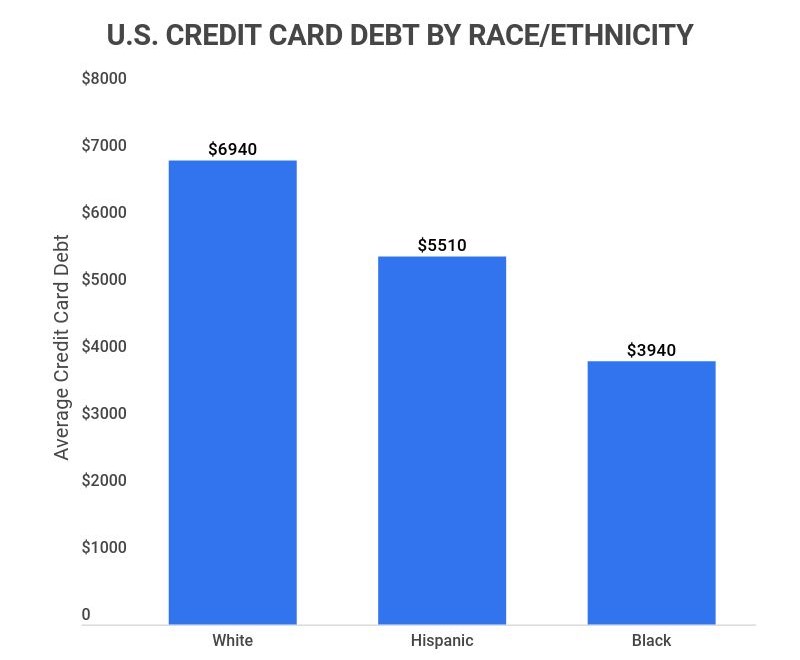

White Americans have the highest average debt of any race, at an average of $6,940 per person.

On the other hand, Black Americans have the lowest average credit card debt, at only $3,940 per person. That means the average White American has 76% more credit card debt than the average Black American.

-

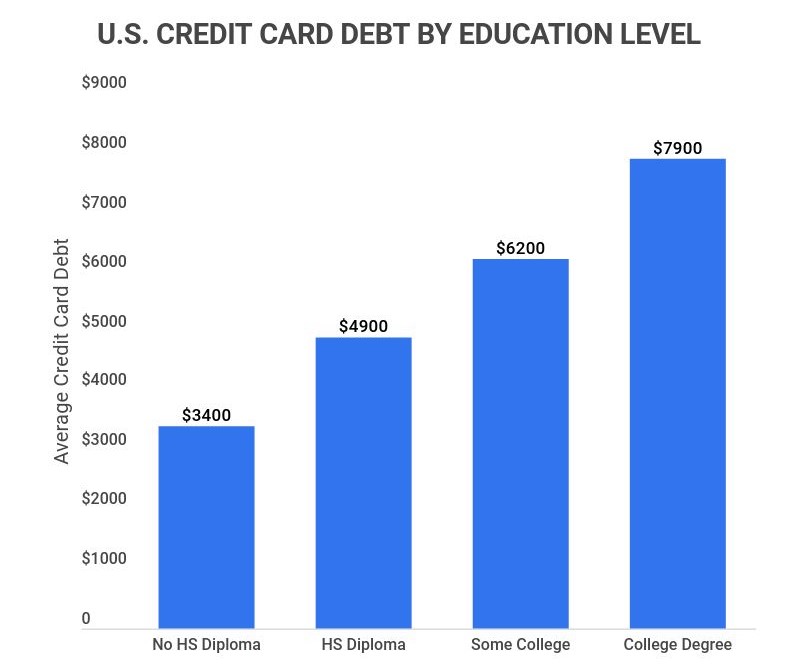

Americans with college degrees have the highest average credit card debt, at $7,900.

That’s over 60% more average debt than Americans who only have a High School Diploma, with their average credit card debt being $4,900.

-

Alaska has the highest average credit card debt per person, at $6,617.

Alaskans have more credit card debt than Americans in any other state, but that doesn’t mean Alaska is the only state with high average credit card debt. In fact, others among the top five include: Connecticut ($6,040), Virginia ($5,992), New Jersey ($5,978), and Maryland ($5,977).

-

Iowa has the lowest average credit card debt per person, at $4,289.

Other states with incredibly low credit card balance averages compared to other states include: Wisconsin ($4,376), Kentucky ($4,521), Idaho ($4,582), and Mississippi ($4,587).

Credit Card Statistics by Credit Card Fraud

Unfortunately, the nature of credit cards makes credit card fraud all too common. Therefore, we’ve gathered all the latest facts on how common credit card fraud is and how it affects people around the U.S.:

-

Globally, credit card companies lost a whopping $32.04 billion to fraud in 2021.

For U.S. consumers especially, there has been a significant spike in credit card fraud since the start of the COVID-19 Pandemic. For example, U.S. consumers alone lost $5.8 billion to fraud in 2021, a 70% increase over the previous year.

-

As of 2020, there were 393,207 reported cases of credit card fraud in the U.S.

Which was a 44.7% increase from 2019, when there were roughly 271,700 cases. Further, even without concrete numbers, it’s clear U.S. credit card fraud reports have continued to rise through 2022.

Credit Card Statistics by Credit Card Companies

Similar to banks, there are a few major credit card companies that dominate the global market. In fact, you likely have a credit card issued by one of the top five largest companies. With that in mind, here are some interesting facts about those companies:

-

Chase is the largest credit card company in the world, with 16.6% of all outstanding balances.

Chase, by far, has the largest percentage of outstanding balances, but there are several other top players in the credit card industry as well. For instance, Citi holds 11.6% of all outstanding balances, followed by American Express (11.3%), Bank of America (10.7%), and Capital One (10.5%).

Company Share of Credit Card Balances Chase 16.6% Citi 11.6% American Express 11.3% Bank of America 10.7% Capital One 10.5% Discover 7.6% Wells Fargo 4.3% U.S. Bank 4.1% Barclays 2.6% Synchrony 2.0% -

Visa cards have the largest purchase volume of any credit card type, at $2.09 trillion.

Visa cards are the most purchased credit card in the U.S., followed by Mastercards ($910 billion), American Express ($828 billion), and Discover ($151 billion).

-

Visa also has the most cards in circulation around the world, at 335 million.

Additionally, others among the top companies by the number of cards in circulation include: Mastercards (200 million), Discover (51.4 million), and American Express (47.5 million).

-

As of 2022, the average APR charged for credit cards that incur interest is 19.68%.

APR can vary based on someone’s credit score, but the average has been increasing in recent years. For instance, the average APR in 2021 was 16.44%.

Global Credit Card Statistics by Credit Card

Credit cards are not only popular in the U.S. but also globally. In fact, out of all 195 countries in the world, less than 50 of them have yet to integrate credit cards into their economy. Here are the facts:

-

There are approximately 2.8 billion credit cards in use worldwide.

And given that 1.1 billion credit cards are in the U.S., that means at least 39% of all credit cards in the world are located in the U.S.

-

As of 2017, Canada had the highest percentage of credit card ownership at 82.6%

Others among the top five countries by credit card usage include: Israel (75%), Norway (70.5%), Luxembourg (69.8%), and Japan (68.4%). In 2017, the U.S. took sixth place, with 65.6% of the population owning a credit card. That number has since increased.

Country Share of Citizens with Credit Cards (2017) Canada 82.6% Israel 75.0% Norway 70.5% Luxembourg 69.8% Japan 68.4% United States 65.6% Switzerland 65.5% Hong Kong 65.4% United Kingdom 65.4% South Korea 63.7%

Other Credit Card Statistics

Last, but certainly not least, here are some additional interesting facts we uncovered about credit cards and the credit card industry: As of 2020, available credit on U.S. credit cards was $3.06 trillion.

-

As of 2020, available credit on U.S. credit cards was $3.06 trillion.

-

60% of Americans believe the US will soon become a cashless society.

-

Gen Z has the least number of credit cards on average, at only 1.7 cards per person.

Credit Card Statistics FAQ

-

What percentage of adults have credit cards?

83% of U.S. adults currently have at least one credit card. That means 26.5% more people now have credit cards in the U.S now than they did just five years ago in 2017. Additionally, the percentage of Americans with credit cards is also much higher than the global average, which is only around 20% of people across all countries.

-

What is the average credit card debt?

The average credit card debt of U.S. families is $6,270. However, this average can vary based on age, location, race, marital status, and more. For instance, the average amount of debt for single U.S. adults is only $4,870, or 41% less than married adults. And other averages include:

-

The average amount of credit card debt for those under 35 is $3,660, but $8,080 for those 75+.

-

The average amount of debt for White Americans is $6,940, but only $3,940 for Black Americans.

-

Americans with college degrees have an average credit card debt of $7,900, compared to only $4,900 for those with a High School Diploma.

-

-

Which country uses credit cards the most?

The countries that use credit cards the most are Canada and the United States. Both of these countries have credit card usage higher than 80%.

Others among the top five countries for credit card usage include: Israel (75%), Norway (70.5%), Luxembourg (69.8%), and Japan (68.4%). In total, at least 143 out of the world’s 195 countries use credit cards.

-

How many credit cards does the average American have?

The average American has 3.8 credit cards. Overall, a considerable 83% of Americans have at least one card, while 34% have three or more cards. Having multiple cards is a common practice because it allows owners to increase their credit limit while also taking a minimal hit to their credit score.

-

How common is credit card fraud?

Credit card fraud is very common, with 47% of Americans falling victim to it within the past 5 years. In 2020 alone there were 393,207 reported cases of credit card fraud in the U.S, which was a 44.7% increase from 2019.

On a global scale, up to $32.2 billion was lost to credit card fraud alone in 2021.

Conclusion

Credit cards are popular all over the world, but especially in the U.S. As of 2022, 83% of Americans now own at least one credit card, and there are 1.1 billion credit cards in the U.S.

Of course, this massive volume of credit cards also means there’s an abundance of debt in the U.S. as well. In total, U.S. credit card debt has reached $856 billion, with an average debt of $6,270 per family. And while these numbers are below their 2019 peak of $927 billion, that’s still a lot of debt for families and credit card companies to tackle.

Overall, credit cards are an integral part of the U.S. economy and a popular choice of payment type, which will only become more popular as cash becomes less widely used.

Sources:

-

UpgradedPoints. “Credit Card Ownership Statistics & Facts – By Income, Credit Score, Education Level & More.” Accessed on May 11th, 2022.

-

Statista. “U.S. credit cards – statistics & facts.” Accessed on May 11th, 2022.

-

ValuePenguin. “Average Credit Card Debt in America: 2021.” Accessed on May 11th, 2022.

-

CNBC. “Americans have an average of 4 credit cards—is that too many?” Accessed on May 11th, 2022.

-

PaymentsJournal. “Consumers Prefer Credit Over Debit for These Types of Purchases:.” Accessed on May 11th, 2022.

-

Statista. “Credit card users in the United States in 2018, by age.” Accessed on May 11th, 2022.

-

Lendingtree. “2022 Credit Card Debt Statistics.” Accessed on May 12th, 2022.

-

American Express. “What is Debt Free Living?” Accessed on May 12th, 2022.

-

Yahoo!. “44% Pay Off Their Full Credit Card Balance, Survey Finds: Pros and Cons of This Strategy.” Accessed on May 12th, 2022.

-

CNBC. “Consumers lost $5.8 billion to fraud last year — up 70% over 2020.” Accessed on May 12th, 2022.

-

The Ascent. “Identity Theft and Credit Card Fraud Statistics for 2021.” Accessed on May 12th, 2022.

-

The Ascent. “The 5 Most Popular Credit Card Companies.” Accessed on May 12th, 2022.

-

Fortunly. “US Credit Card Market Share: Facts and Statistics.” Accessed on May 12th, 2022.

-

Lendingtree. “The Average Credit Card Interest Rate In America Today.” Accessed on May 12th, 2022.

-

Statista. “Value of credit available on credit cards in the United States from 1st quarter 2010 to 2nd quarter 2020.” Accessed on May 12th, 2022.

-

HBR. “Is the U.S. on Its Way to Becoming a Cashless Society?” Accessed on May 12th, 2022.