Tech adoption, including real estate fund software, increased rapidly in mid-2020 due to the COVID-19 pandemic, and it’s no coincidence that commercial real estate investment rebounded at the end of the year, posting an 84% rise in deal volume in the fourth quarter. As competition in the real estate market continues to rise, deal-makers must leverage the power of real estate fund software like DealCloud to more efficiently manage their deals and build strong pipelines. Unsurprisingly, implementing real estate fund management software is a fast-growing trend in the industry; Deloitte’s 2021 CRE Outlook report shows that 43% of CRE firms plan to increase their investment in technology during the next year. Finding the best software for real estate investors may not be easy, but it’s worth the time and effort.

Know where every deal stands at any moment

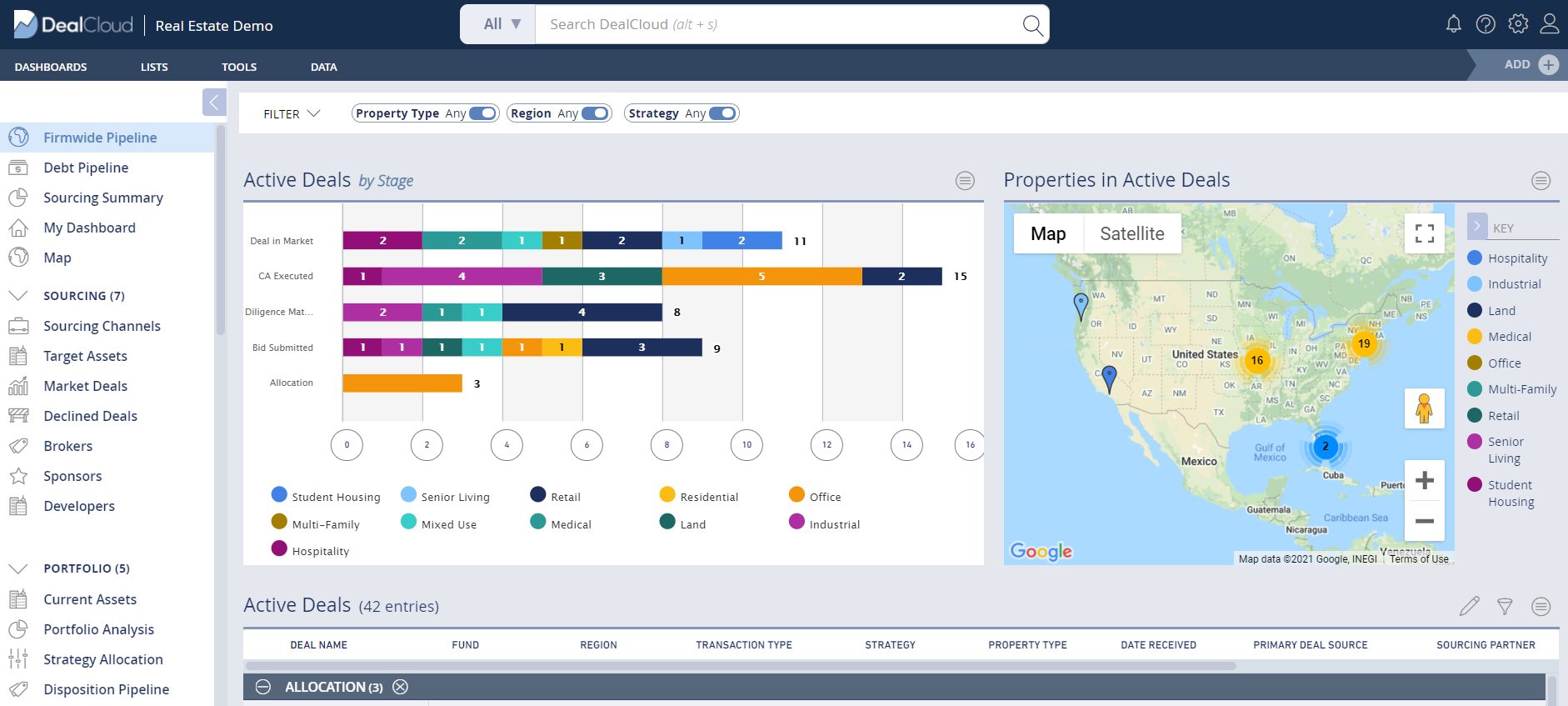

It’s important for deal-makers to have a 360-degree view of their pipelines at all times. By leveraging DealCloud real estate deal tracking software, users can stay up to date on all deal activity using a firmwide pipeline dashboard that serves as the single source of truth for all pipeline data.

The firmwide pipeline dashboard provides a full picture view of the firm’s deal activity.

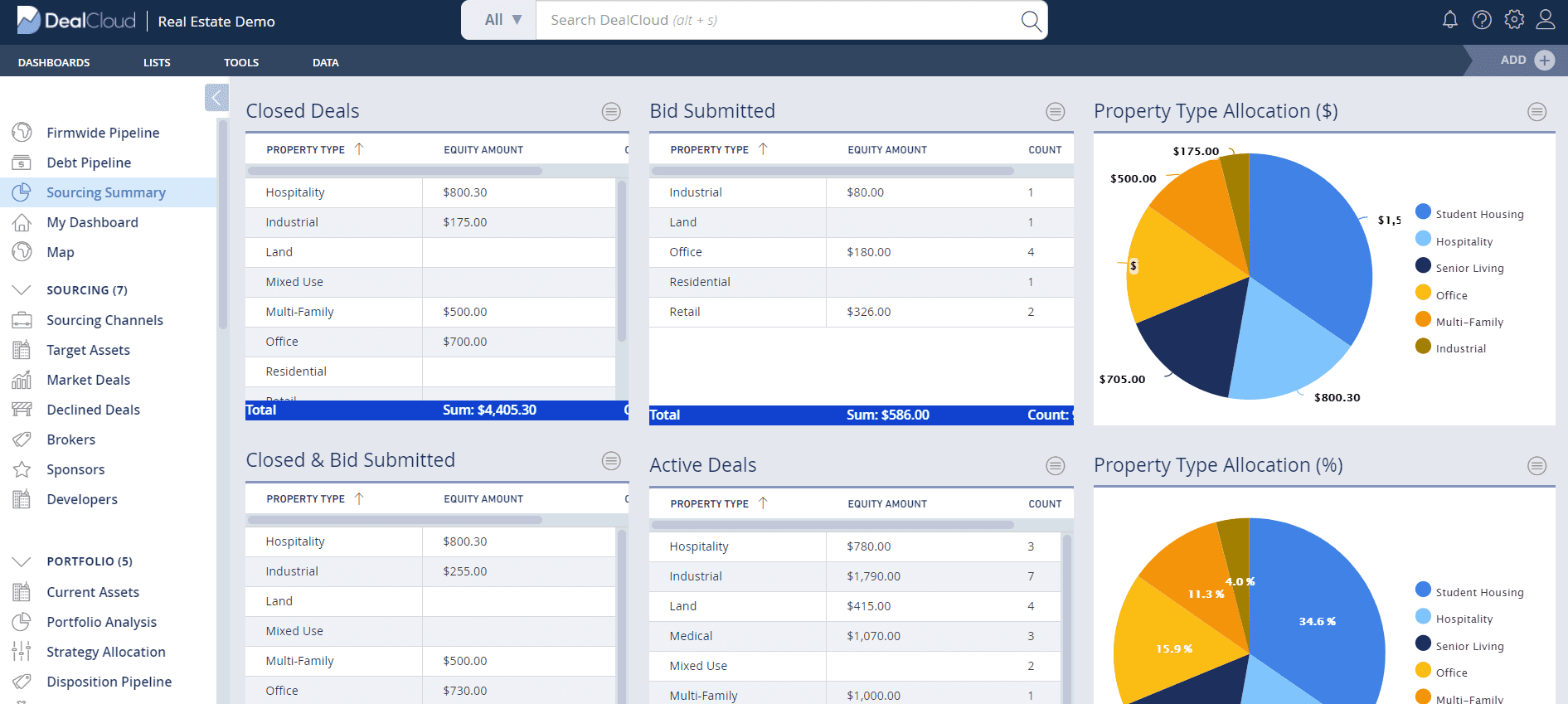

It’s also important for firms to track deal sourcing in real time. Using the Sourcing Summary dashboard in DealCloud, investors can monitor all sourcing activity in one place, creating transparency across the team.

Deal-makers can view a summary of sourcing activity including closed deals, bids submitted, active deals, and more.

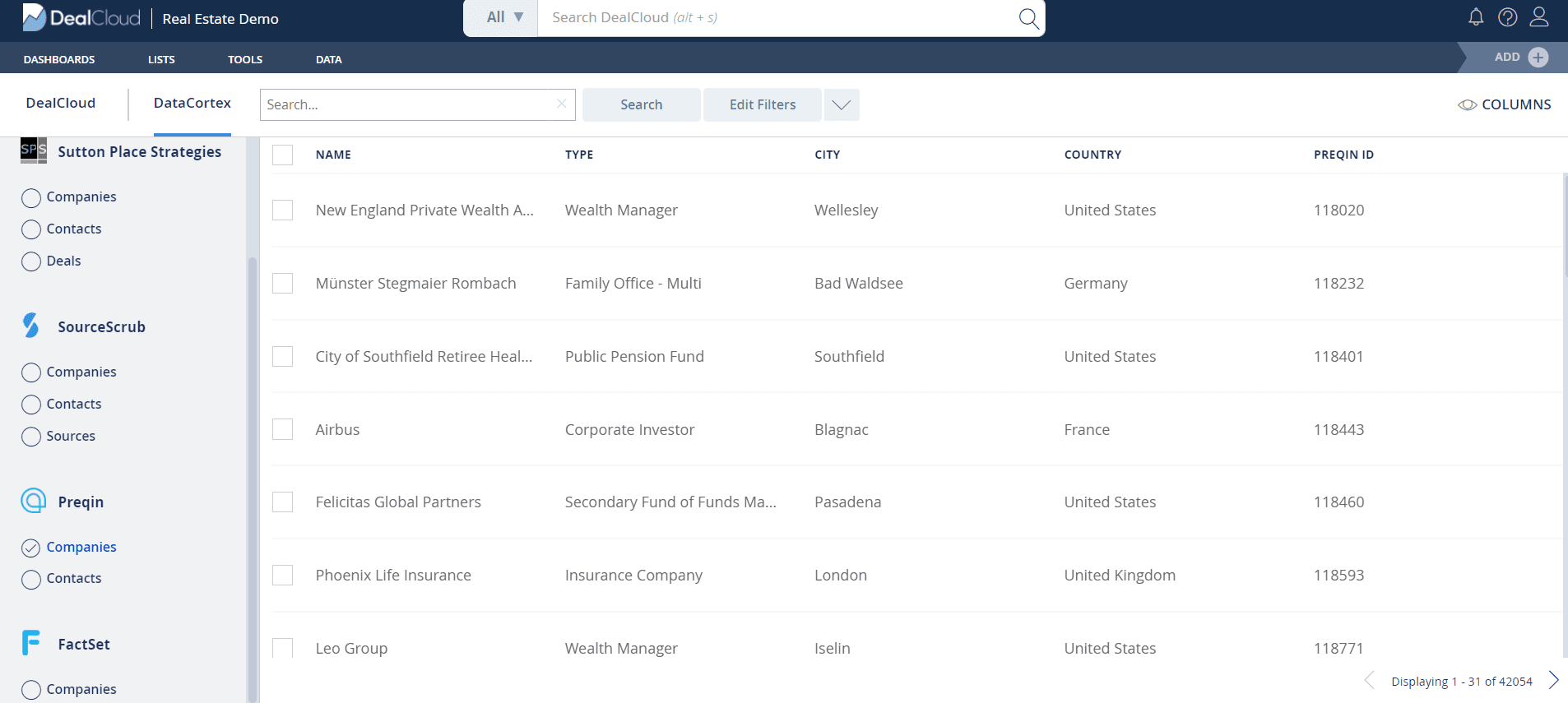

It’s also crucial for deal-makers to have access to proprietary and third-party data when building a strong pipeline. The DealCloud data management platform, DataCortex, integrates directly into the DealCloud real estate fund software. DealCloud partners with capital markets data providers including FactSet, Preqin, Pitchbook, PrivCo, Sourcescrub, and others.

Within DataCortex, deal-makers can easily run complex reports, analyze industry trends, and evaluate potential synergies in the same hub where they originate deals and manage relationships. DataCortex helps deal-makers make critical decisions more quickly, and identify new, meaningful opportunities.

Create more effective pipelines with automation

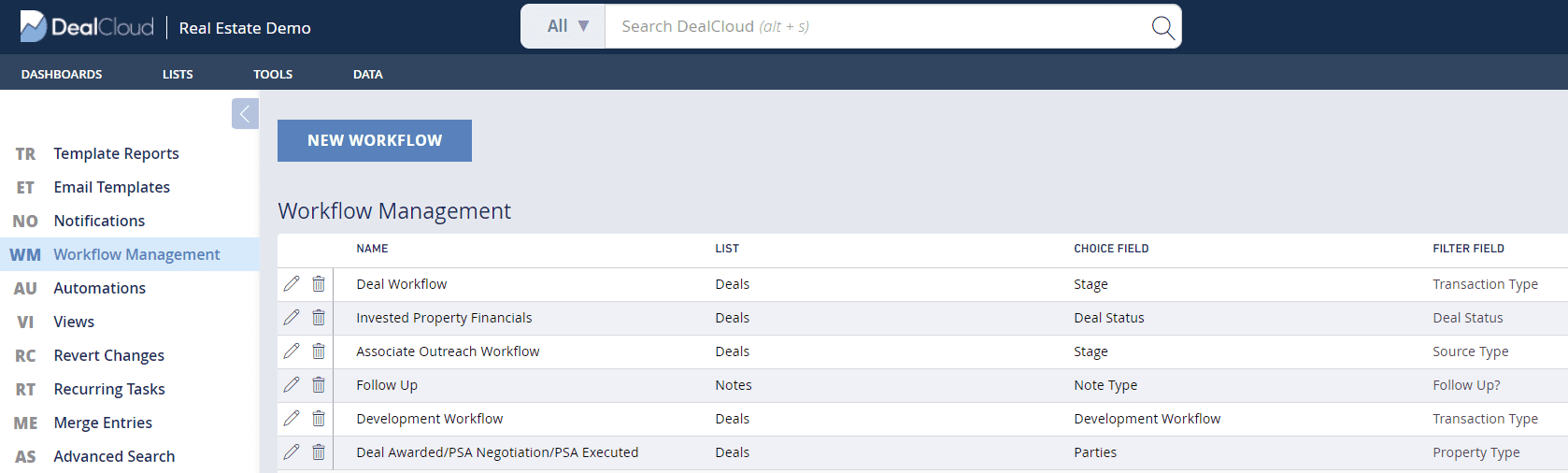

Many real estate investors follow a standardized workflow process during a transaction, creating and assigning predetermined tasks across their firm. Trying to systematize these tasks in a traditional CRM, — which is not designed to handle these workflows — oftentimes leads to increased costs and lost productivity; the investors ultimately resort to purchasing separate workflow management technology or simply abandon the CRM and instead use Microsoft Excel spreadsheets and Microsoft Outlook calendar notifications.

DealCloud real estate fund software was designed specifically for real estate deal-makers, and includes a fully configurable workflow engine that’s integrated with an investor’s deal-flow tracking and execution. Anyone with proper permissions can design and set up new workflows. You can assigned tasks to specific groups on the team with the option to require a step-by-step progression; you can also require that all tasks are completed before a deal progresses through the pipeline.

Provide clarity and efficiency with real estate fund software

Commercial real estate investment is often a complicated web of interconnected relationships, deals, properties, and other variables. Effectively managing all these data points to drive performance and efficiency requires a more dynamic and sophisticated approach than the linear connection between a buyer and seller that deal-makers have grown accustomed to using. Real estate fund management software like DealCloud allows deal-makers to act on their data in ways that were never before possible, creating endless opportunities to improve overall performance and drive firm efficiency.

Schedule a demo to learn more about DealCloud’s real estate deal tracking software.