Buying and protecting your engagement ring

2021 State of the Art Survey & Report from BriteCo

2021 State of the Art Survey & Report from BriteCo

December is the month that most couples get engaged, and this holiday season promises to be a big one for jewelry sales. Selecting and purchasing a high value (typically diamond) engagement ring is a time-honored tradition that continues today. But for those making this major purchase (one of the biggest in their lives), the process of buying, insuring and protecting an engagement ring can seem daunting.

To help expectant engagement ring buyers get their bearings, BriteCo jewelry and watch insurance conducted a survey among 758 consumers in the U.S. in October 2021, of which 400 bought an engagement ring within the past 10 years. While our findings are consistent with other types of surveys of engagement ring buyers, there are some surprising results that should prove valuable to consumers looking to make an informed decision.

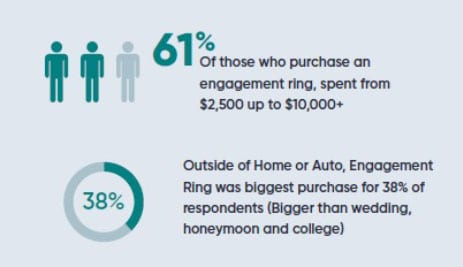

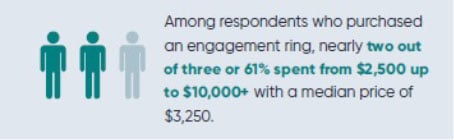

Among respondents who purchased an engagement ring, nearly two out of three or 61% spent from $2,500 up to $10,000+ with a median price overall of $3,250. Buying an engagement ring ranked as the number one biggest purchase outside of a home or auto for 38% of respondents, ahead of wedding, honeymoon, medical or college costs.

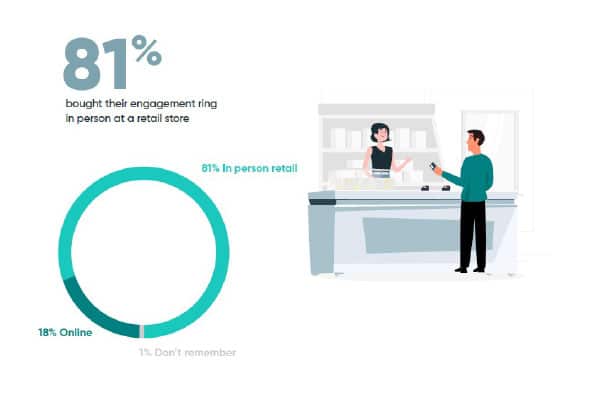

In person sales of engagement rings at retail still dominate with 81% buying directly in person from a jewelry store or department store. Only 9% of respondents purchased their ring through an online-only jewelry website with another 11% buying through a retail jewelry store’s website.

Most buyers preferred an in person buying experience because they trusted the retail jeweler, and had purchased from them previously, or felt the retail store had the best quality, and price. And in making their selection, sustainability was a high priority with 85% of respondents ranking it very or somewhat important in their purchase decision.

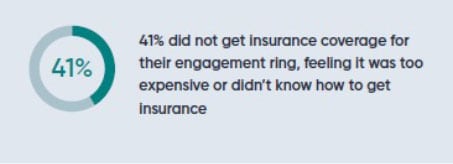

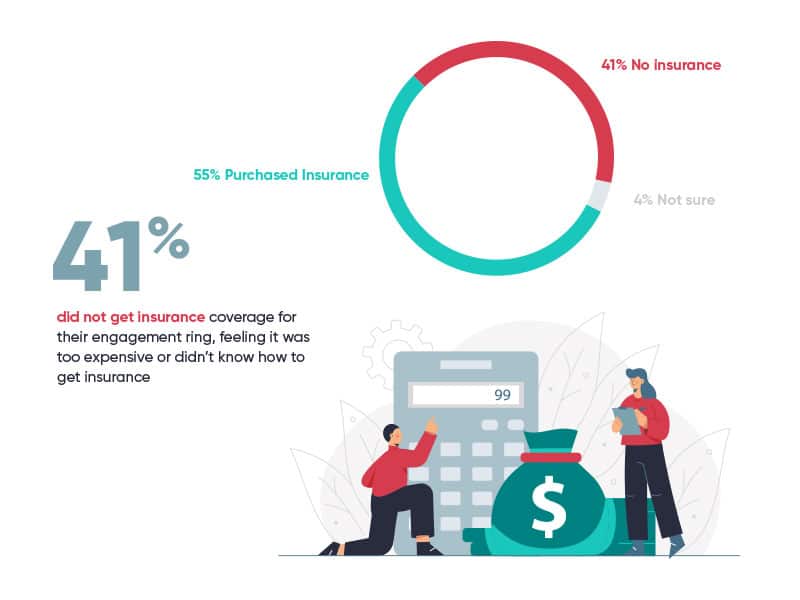

While making one of the major purchases of their lives, it is shocking that close to half or 41% of respondents did not get jewelry insurance coverage for their engagement rings.

What were the reasons for not getting engagement ring insurance?

Most felt it was too expensive or didn’t even know they could get insurance in the first place. Others simply didn’t know where they could purchase engagement ring insurance.

While about 25% did purchase an engagement ring warranty, they may have been under the mistaken impression that a warranty would protect their ring from loss, theft, or “mysterious disappearance” — coverage that only comes with insurance.

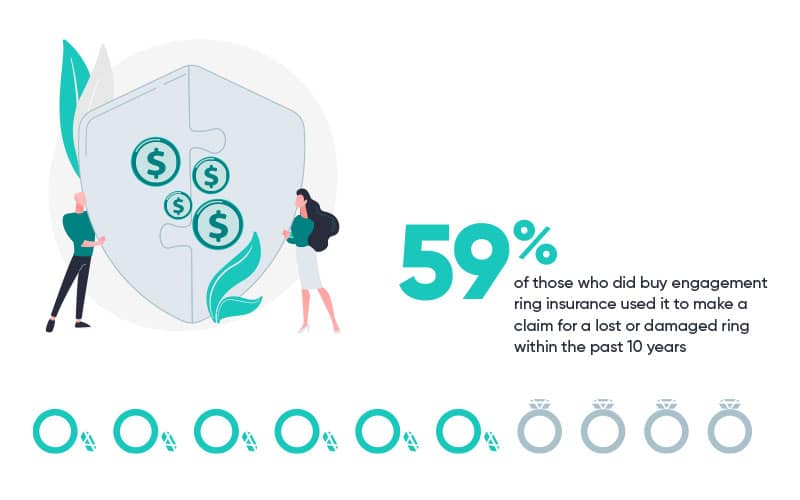

Most disturbing for those uninsured engagement ring buyers: Nearly two out of three engagement ring purchasers (59%) who did buy a jewelry insurance policy actually made a claim for a lost or damaged engagement ring within the past 10 years!

The lesson for engagement ring buyers is clear. Buying jewelry insurance to protect your engagement ring makes sense, especially since it is readily available, affordable and chances are high they will be needing it someday.

Nearly all survey respondents trusted their significant other completely to safeguard their engagement ring. However, when indicating their habits for losing or misplacing jewelry (compared with things like cell phones, keys, etc.), 41% said they misplaced their jewelry or watch either every day or sometimes.

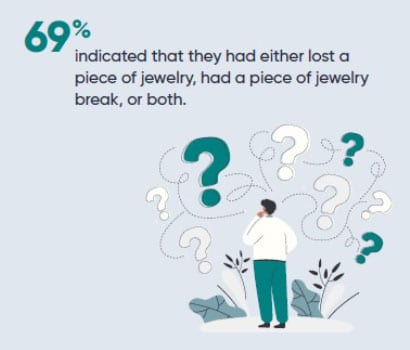

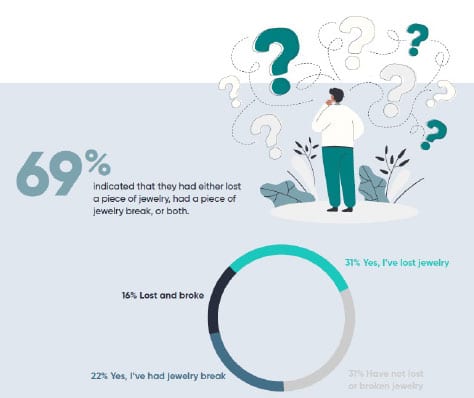

When asked if they had ever lost a piece of jewelry or had it break, 40% indicated that they had lost a piece of jewelry and another 33% said they had a piece of jewelry break. Nearly half or 45% said they store their jewelry in a jewelry box. Another 25% store their jewelry in a home safe, while 18% say they never remove their jewelry.

Overall, the perception by respondents of how well they or their significant other can safeguard their engagement ring is contradicted by their own risky behavior and by how often they have had to repair or replace an engagement ring or other piece of jewelry.

41% said they misplaced their jewelry or watch either every day or sometimes

69% indicated that they had either lost a piece of jewelry, had a piece of jewelry break, or both.

Among survey respondents who bought an engagement ring, the vast majority were men (86%).

90 percent of the respondents were still married.

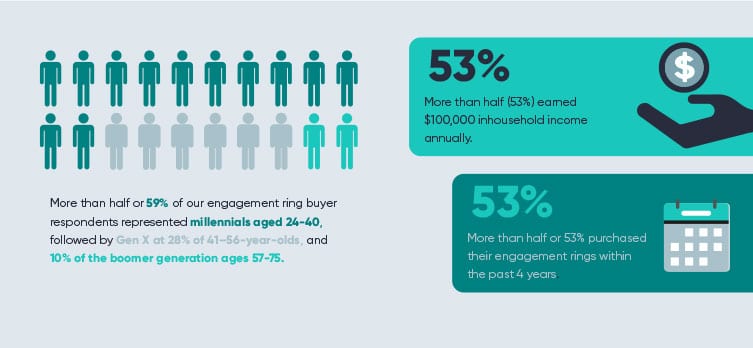

More than half or 59% of our engagement ring buyer respondents represented millennials aged 24-40, followed by Gen X at 28% of 41–56-year-olds, and 10% of the boomer generation ages 57-75.

More than half (53%) earned $100,000 in household income annually, and an equal number, 53% purchased their engagement rings within the past 4 years.

Here’s what your peers revealed about their engagement ring buying, insurance, wearing and storing experience.

Among respondents who purchased an engagement ring, nearly two out of three or 61% spent from $2,500 up to $10,000+ with a median price of $3,250.

Nearly all spent about what they expected to pay for their engagement rings.

Engagement ring spending compares to another recent study entitled 2021 WeddingWire Newlywed Report, where the average spent on an engagement ring was $5,500. While this study indicated about half of couples will spend under $5,000 on their engagement ring.

Nearly 1 in 5 or 18 percent spent more than $10,000!

Among our survey respondents, spending on their engagement rings was one of the biggest purchases they had made outside of buying a home or an automobile. Buying an engagement ring ranked as a top expense by 38% of respondents, ahead of wedding, honeymoon, medical or college costs.

Only 9% of respondents purchased their ring through an online only jewelry website. 10% bought from a jewelry store’s website, and 81% directly in person from a jewelry store or department store. The proportion of people buying an engagement ring online was about the same regardless of how much they spent on their purchase.

When asked why they chose to purchase either in person or online, in person purchasers prioritized trustworthiness, as well as their feelings towards wanting to buy their ring in person. Online-purchasers, on the other hand, bought online mainly because of its convenience. They also believed that their online store would have the best prices, trusted their online store, and had read good reviews about them online before purchasing.

Reasoning for Store Type in Ring Purchase

(Based on Percentage of Responses)

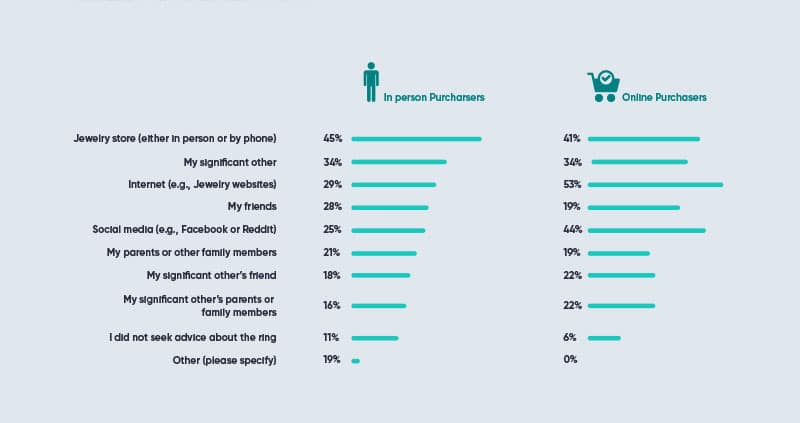

For in person ring purchases, respondents typically rely on a jewelry store employee for advice, followed by their significant other, and the internet. Online ring purchasers, however, are more likely to seek advice from the internet, followed by social media, and In person jewelry stores.

Where do engagement ring purchasers get advice?

On a side note, sustainability was considered very or somewhat important in any engagement ring selection by 85% of respondents (increasing to 90% among women only). This echoes a 2021 Diamond Insight Report from DeBeers that indicated about a third of consumers globally value sustainability above price and design when choosing a natural diamond.

Cash is the most common payment method when buying an enagement ring.

Overall, engagement ring purchasers felt very happy or satisfied with their engagement rings.

While the median price for an engagement ring is at $3,250, 38% of respondents are spending from $5,000 to $10,000 or more.

Engagement ring purchasers (80% are men) find it helpful to research an engagement ring purchase online but four out of five prefer to see and touch in person with a local jeweler.

Engagement ring buyers mainly rely on a jewelry store employee for advice as well as their significant other, parents and friends for advice on where to buy their ring. And they place a high value on the sustainability of their purchase.

Not getting insurance is a major problem since for engagement ring purchasers this was often (38%) the largest purchase of their life outside of their house or car. Can you imagine not insuring your home or auto?

The reasons for not getting engagement ring insurance? Most felt it was too expensive or didn’t even know they could get insurance. Others simply didn’t know how to go about getting insurance. Others might have mistakenly thought that getting a warranty would cover loss, theft or mysterious disappearance—it does not!

Those without insurance, or those relying strictly on a warranty would likely be left to pay out of their own pocket to replace one of their most precious possessions should it be lost, stolen or misplaced. And this is not a remote possibility.

Experienced jewelry buyers are much more likely to have insured their engagement ring, with 68% of jewelry buyers getting insurance, versus 55% of those who rarely if ever buy jewelry. The more they spent on jewelry the more likely they were to buy jewelry insurance.

That’s because nearly two out of three engagement ring purchaser survey respondents (59%) who bought insurance used it to actually make an insurance claim for a lost or damaged engagement ring within the past 10 years.

Generally, a warranty is an agreement put forth by the original manufacturer or retailer of your engagement ring, wedding ring, earrings, or luxury watch as a conditional statement of quality, for a set period of time after you purchased the item. Jewelry warranties do vary, but they should all state the registration terms, what’s covered or not covered, and for how long. You may get a “warranty card” with your fine jewelry purchase spelling out the terms of your warranty. Be sure to read it carefully.

Jewelry warranties typically cover manufacturing defects, flaws in design, materials, or workmanship, cleanings, and resizing for engagement rings and wedding bands. Jewelry warranties DO NOT typically cover things such as wear and tear, bent or missing prongs, discoloration from unapproved cleaning agents, loss of a center stone/pearl/backing, repairs or maintenance done outside the original seller. Most important, jewelry warranties will not cover replacement if a ring is stolen or lost due to mysterious circumstances.

Specialized jewelry insurance, on the other hand, generally offers worldwide coverage for loss, theft, damage or what’s called “mysterious disappearance.” This is important since most insurance claims for jewelry involve unexplained loss.

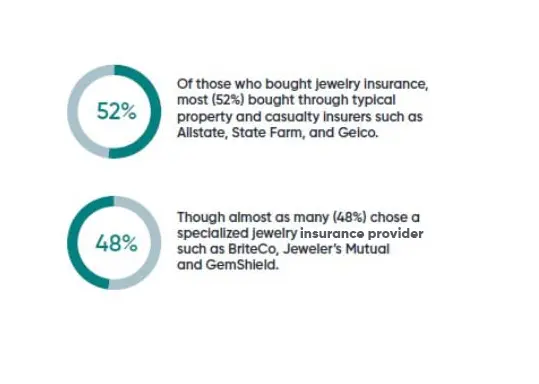

Of those who bought jewelry insurance, most (52%) bought through typical property and casualty insurers such as Allstate, State Farm, and Geico.

Though almost as many (48%) chose a specialized jewelry insurance provider such as BriteCo, Jeweler’s Mutual and GemShield.

Nearly three out of four engagement ring buyers with insurance policies had deductibles associated with their policy. In many cases, policy holders include deductibles to help reduce the cost of insurance, however, this can leave them with large out of pocket expenses in the case of claim.

While high-value engagement rings may justify some kind of deductible, it is surprising to see that almost two thirds of respondents or 64% had deductibles above $2,000 or more.

Even more surprising, 40% have jewelry insurance deductibles of $5,000 and up. That’s obviously a substantial out of pocket cost should anything happen to the ring.

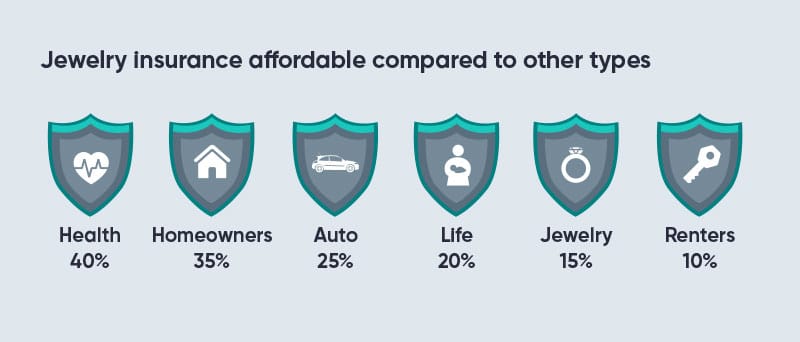

Even though an engagement ring is a major purchase for our respondents, for those who bought jewelry insurance the cost was relatively less than other kinds of insurance coverage.

Respondents revealed that their health insurance is the insurance type they consider most expensive, followed by homeowners’ insurance, and auto insurance. Jewelry insurance falls towards the lower half of the list, ranking as one of the most affordable insurance types among those who currently pay for it

Get your engagement ring insured as soon as you purchase it (even before you pop the question) to avoid any heartache and monetary loss of your hard-earned investment. Odds are most of you will need to make a claim at some point.

Keep in mind that purchasing an engagement ring warranty is different from getting full insurance coverage for loss, theft or what’s known as “mysterious disappearance.”

Nearly all respondents trusted their significant other completely to safeguard their engagement ring.

However, when indicating their habits for losing or misplacing jewelry (compared with things like cell phones, keys, etc.) 41 percent said they misplaced their jewelry or watch either every day or sometimes.

At the same time, when at home only 25% of respondents used a safe to store their engagement ring when not wearing and 18% never remove it. 45% placed their jewelry in a jewelry box.

Overall, the perception of safety with an engagement ring is contradicted by people’s behavior and by how often they need to repair or replace the engagement ring. So, while people may perceive themselves as feeling secure about safeguarding their engagement ring and other jewelry, their admitted behaviors suggest most will at some point lose or damage a piece of jewelry.

From our vantage point as a jewelry InsurTech provider, BriteCo is dedicated to proactively protecting the joy and pride of jewelry and engagement ring ownership. Since the engagement ring is often one of the largest purchases (and investments) any couple makes, we take on the responsibility as an industry innovator to utilize our data to help engaged individuals prevent and mitigate loss of their most prized possessions in the first place.

As such we are using the information and data we collect, including this survey, to help make jewelry purchasers aware of their options to achieve convenient and affordable coverage. There is no reason in this digital age why anyone need risk the theft, loss or mysterious disappearance of an engagement ring or any other piece of fine jewelry, including watches.

To learn more visit BriteCo jewelry and watch insurance at brite.co to get a customer quote on insuring your items in 60 seconds.

The survey was conducted online with 758 respondents in October 2021. Among the survey respondents who bought an engagement ring, the vast majority were men (86%), but also a significant portion were women (14%). Interestingly, 90 percent of the respondents were still married to the person they bought the ring for. More than half or 59% of our engagement ring buyer respondents represented millennials aged 24-40, followed by 28% of 41-56 years old, and 10% of the boomer generation ages 57-75. More than half or 53% earned $100,000 in household income annually, and 53% had purchased their engagement rings within the past 4 years.

Established in 2017 by a third-generation retail jeweler, BriteCo is a leading, U.S.-based insurance technology provider obsessed with revolutionizing the jewelry appraisal and insurance industry. First to introduce a free streamlined, cloud-based jewelry appraisal platform supporting thousands of independent retail jewelers across the United States, BriteCo continues to innovate by democratizing the process of buying 5-star rated jewelry insurance for consumers with an easy-to-use online application and affordable subscription-like monthly payment option.

To learn more visit BriteCo.