I understand that getting a personal loan with a bad credit history is one of the most hectic procedures you face.

Many lending institutions have become more careful when choosing who to lend their money to in these challenging times. The majority of these institutions run borrower’s credit checks before they lend them money.

However, there are bad credit personal loans with guaranteed approval of $ 5000 that you can try out today. Some of these $5,000 lenders do not run credit checks on their borrowers. Therefore, you should be more careful when applying for these loans before entering into a debt trap.

What are Bad Credit Guaranteed Approval $5,000 Loans & How Do They Work?

Bad credit guaranteed approval $5000 loans are those that anyone with a bad credit history can apply. In addition, these bad credits assured approval of $5,000 loans gives the borrower smart deals like lower A.P.R.s and installment payments.

It would be best to stop worrying about your bad credit score because you can get a loan regardless of your bad credit history. In addition, there is a guaranteed approval of unsecured loans that you can get with bad credit.

It will be an excellent deal to get an installment loan without credit checks. You will be able to pay in small bits for an extended period until you pay the loan in full. The ability to repay the loan for a more extended period gives the borrower ample time to repay in time hence building their credit scores.

How bad credit installment loans work

- The borrower discusses with the lender the terms of the loan until they get to a mutual agreement.

- You have to fill the form and provide all the requirements needed, such as identification documents.

- Specify how you will use the loan, such as building a house, buying a car, or starting a business. However, some lenders do not request what you will do with the loans.

- The lender might request a downpayment. But still, not all lenders ask for a downpayment. However, if you pay a downpayment, you will pay the loan for a shorter period. In addition, it can also reduce the monthly installment amounts to pay.

- The loan gets approved. Once the lender approves your loan, they deposit the cash direct to your checking bank account.

- You pay installments as per your agreement until you repay the loan completely.

Examples of Bad Credit Guaranteed Approval $5,000 Loans

Here are some ways to get a guaranteed loan for bad credit.

1. Bad credit guaranteed approval of $5,000 for business

Yes, you can get a $5,000 business loan with bad credit. Most lenders will want to know how long you have been in business to give you a business loan. They can also assess your business to understand its worthiness and give you a loan without credit checks.

Alternatively, you can provide collateral to get bad credit installment loans guaranteed approval by the lenders in the U.S.A. In addition, lenders base their decision on the frequency of your business cash flow.

2. Bad credit guaranteed approval of $5,000 for startup business

Again, if you are starting a business but have a bad credit history, you can get a business loan. You can get a loan for a business startup in Bluevine, where you will need to provide the unpaid invoices. Bluevine has an A.P.R. ranging from 15% to 68%, with a minimum credit score requirement of 530.

Going to the traditional banks to get a business startup loan with bad credit can be discouraging. The banks have a lot of requirements before they approve your business startup loan.

And, that’s why some online platforms like Heartpaydays link those in need of business startups to suitable lenders. In addition, the process is usually straightforward, making it convenient and faster for business startup loans.

3. Bad credit guaranteed approval of $5,000 for refinancing auto loans

It’s possible to refinance an auto loan with a bad credit history. However, you have to make timely payments, and you will be building your credit score. Some lenders focus on refinancing auto loans for people or businesses with bad credit scores.

You can refinance an auto loan if you want to lower the loan interests, or if you wish to have new terms for the loan, or even if you’re going to reduce the number of installments.

Again, refinancing an auto loan is possible with online platforms like Heartpaydays.

4. Bad credit personal loans guaranteed approval on Centrelink

You can also get a bad credit personal loan guaranteed approval if you are getting a Centrelink income. The lenders match your Centrelink income to determine the amount of loan you should pay and for how long.

The lenders charge Centrelink loans an establishment fee of 20% and a loan maintenance fee of 4% each month. In addition, lenders don’t charge early repayment fees if you pay the loan early than the designated time.

However, there are fees associated with Centrelink loans if you do not repay your loan on time.

Features of Bad Credit Guaranteed Approval $5,000 Loan

Here are the specific characteristics of bad credit personal loans guaranteed approval with no credit check. These loans are for the people or businesses struggling to get loans with a bad credit score.

The characteristics make it possible for bad credit people or companies to build up their credit score by paying the installments in time.

Now, let’s look at the specifications of these bad credit guaranteed approval of $5,000 loans.

You can borrow in lumpsum

Because of their nature, the borrower can do more significant projects with this lousy credit-guaranteed approval of $5,000 loans. This lumpsum feature is better compared to payday loans that are small and short-termed.

With Bad credit installment loans, you can borrow vast amounts of money and pay in small bits. The longer the repayment period, the less impact the loan has on the borrower. In addition, the payment of each installment is small, making it easier to repay the loan.

You can use the installment loan for the purpose you like

There are no restrictions on what you should do with the money you get through tribal installment loans. The borrower decides on what they should do with the money borrowed. The lender is just concerned about the repayment procedure and not how the borrower will use the loan.

However, there are specific installment loans like mortgages, car loans, and also business loans.

They are long term

A bad credit installment loan can be spread over an extended period depending on the loan amount. In this case, the borrower is not pressed beyond limits to repay the loan.

And, that’s how borrowers manage to rebuild their credit scores because they agree on the amount of each installment.

Budgetible payments

Since you have the amount of each installment and the repayment date, it will be easier to budget your funds to fit the schedule. These installments ensure that you make timely payments hence improving your credit score in the end.

Furthermore, the installment loans make it easier to plan on investment plans since you know how much you will save after all the deductions.

In addition, installment loans make it easier to know when you will be able to clear off your debt. Finally, the knowledge of completing the loan allows you to arrange for any future loans that you want to take.

Those with bad credit can get the loan

With installment loans, no specifications restricting the people or businesses with bad credit, they can comfortably apply for the loan and get approved.

Charges and Penalties for Bad Credit Guaranteed Approval $5,000 Loans

Some charges apply if you fail to repay the bad credit guaranteed approval $5,000 loans.

They include:

- The first action that the lender takes is that they will call and send you reminder messages to confirm that you are aware of your pending debts.

- Your bank can charge you a returned check fee associated with insufficient funds in the account.

- If the lender involves a third party to collect the debt, there are also extra costs.

- The lender can double the interest for the unpaid installment. However, it will become harder for the borrower to repay the loan in total amount once this happens.

- There is a negative impact on your credit score if you delay paying the Bad Credit Long Term Loans Guaranteed Approval.

- You may receive a court summons whereby you will have to sign an agreement on when to repay the loan.

- You can be penalized such that you cannot borrow in the future. There is no other lender who will be able to lend you money with your bad credit again.

The secret of avoiding the penalties mentioned above is ensuring that all installments are paid on a timely basis and in full. In addition, repaying on time improves your lousy credit score and become eligible for better loans with good terms. I’m sure you don’t want to keep rotating in debts left, right, and center.

The Eligibility Criteria for the Bad Credit Guaranteed Approval $5,000 Loans in the U.S.A.

To get the bad credit guaranteed approval of $5,000, you have to go through vetting criteria before getting any personal or business loan.

- You must have 18 years of age before you can apply for bad credit guaranteed approval $5000 loans.

- It’s a must to have the Social Security Number.

- Must have an active checking account, where the lender will deposit the money.

- It would be best if you were a confirmed citizen and resident of the U.S.A.

- You must provide a National Identification Document.

How to Apply Loans for Bad Credit Guaranteed Approval $5,000 Loans in Quick Steps

Here is the step-by-step guide to applying for bad credit guaranteed approval loans.

Step 1: Choose your loan amount

You should first assess yourself and know the amount of loan you want. Remember, you should only take the loan that you want to use at the moment. Avoid taking a lot of money you don’t need because that will add the installments and the repayment period.

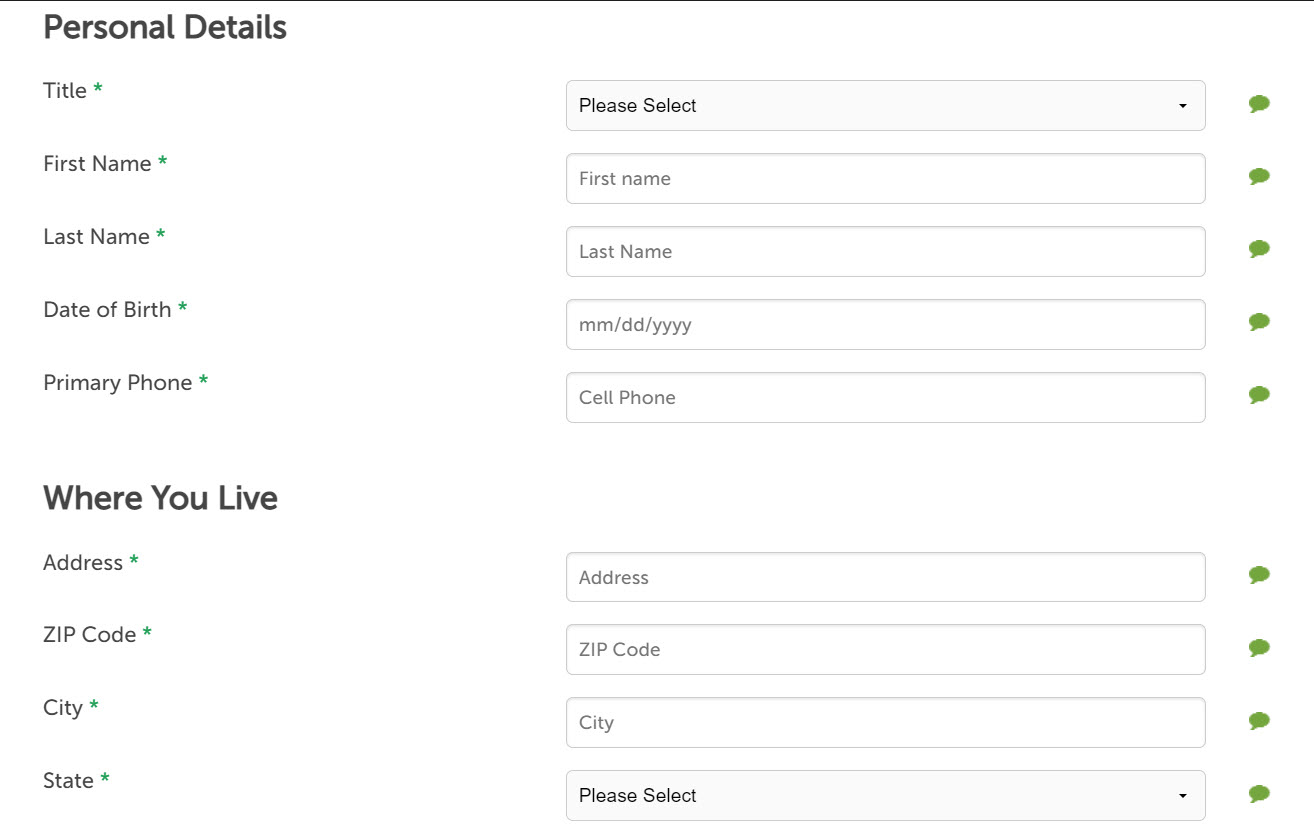

Step 2: Complete the application form

After you choose the amount of loan you want, there will be a form to fill in your details. Ensure that you provide all that you are requested to give. Thoroughly and accurately filled application forms increase the chances of approval.

Step 3: Wait for a decision

After filling the application form, you should now wait for a response from the lender. At this stage, the lender confirms whether you have filled the form correctly. In addition, the lender also ensures whether you have provided the requirements for you to get approved.

Step 4: Get your loan

After the lender approves your documents, you will be able to receive the loan directly to your bank account.

It’s that straightforward!

How to Find the Best Bad Credit Guaranteed Approval $5,000 Loans rates in the U.S.A.?

With that easy procedure of applying for a $5,000 Installment Loan For Bad Credit, you may wonder where you can get these kinds of loans.

Well, I got you covered. The Heart Paydays loans broker has good deals concerning the bad credit guaranteed approval loans. In addition, the lenders in the Heart payday loans do not conduct credit checks in the three credit bureaus. Thus, having bad credit will not limit you from getting a loan.

The Heartpayday platform has lenders with a cheaper A.P.R. ranging from 5.99% to 35.99%. This A.P.R. is relatively inexpensive compared to other 2500 installment loans for bad credit direct lenders.

Therefore, it’s always advisable to get loans with a cheaper A.P.R. Remember, the higher the A.P.R., the more likely the payment will be burdensome.

You can pay for the Heart payday loan for a period of 3 to 6 months. The period is relatively fair, and it gives the borrower ample time to repay the installment loans on time.

Conclusion

It’s possible to get bad credit guaranteed approval loans regardless of your previous credit history. However, if you fear getting approved for loans, consider going for the Heartpayday loans, and you will get approved in a short while.

To get better deals on bad credit guaranteed approval loans, head right now to the Heart payday loans, and you will get what you want.

FAQs

How to get a bad credit loan?

You can get a bad credit loan by looking for the Heart payday loans. The platform will match you with suitable lenders who give you a bad credit loan with instant approval.

How Can I Apply with Loan Providers That Will Not Perform a Credit Check?

The Heart payday platform has lenders who do not run a credit check. You can also provide collateral to the lender, and they will not need to run a credit check before approving your bad credit loan.

How Long Does Heartpaydays Take to Approve a Loan Application?

Heartpaydays take approximately up to 24 hours to approve your bad credit loan. However, some banks may not support fast payments. But this entirely depends on your bank and not the Heartpaydays.

Are installment loans secured or unsecured?

An installment loan can either be secured or non-secured. If you decide to take a secured installment loan, you will have to provide collateral to get approved for the loan. However, there are also installment loans that do not require you to have collateral.

How Can I Apply For Bad Credit Installment Loans?

Go to Heartpaydays.com and request funds. After there, the platform will direct you to fill an application form.

Is it correct to apply for an installment loan online?

Yes. It’s the easiest and quickest way to get your loan approved. You don’t have to waste time to and from a traditional bank while applying for an installment loan.

Where to get a $5,000 loan?

You can get a $5,000 loan at Heartpaydays. They give loans starting from $100 up to $5,000. There is also pocket-friendly A.P.R. that ranges from 5.99% to 35.99%.

How do installment loans affect your credit?

Installment loans help in building your credit score. In addition, the lenders update the timely payments of the monthly installments on the three credit bureaus.

What credit score do I need to apply for a $3000 loan?

Having a credit score of 590 and above can make you eligible to qualify for a $3,000 loan.

How Heart Paydays work?

- You will conduct everything in Heartpaydays online, hence the ability to get the loan quickly

- You can apply from $100 up to a $5,000 installment loan

- The lenders assess your application and then decide on what terms you should use before you get the loan

- Some lenders don’t run borrower’s credit checks, so those with bad credit can get loans on the platform

- After agreeing on the statement, the lender releases your loan directly to your bank

- If you disagree with the terms of one lender, you can always try another lender to get the loan you want.