There are two main ways for startups to raise capital in the US. Venture capital (VC) firms and high-net worth individuals have been a major source of funding for a while, thanks to the Small Business Investment Act of 1958. The second option, online startup investing, became available more recently through the JOBS Act in 2012. Through online startup investing, companies can raise funds directly from individuals, regardless of how wealthy they are. Despite both being types of startup investing, the VC market and the online investing markets started decades apart and serve different types of investors. The VC market is well-known for dealing with massive amounts of capital. But which market is growing the fastest?

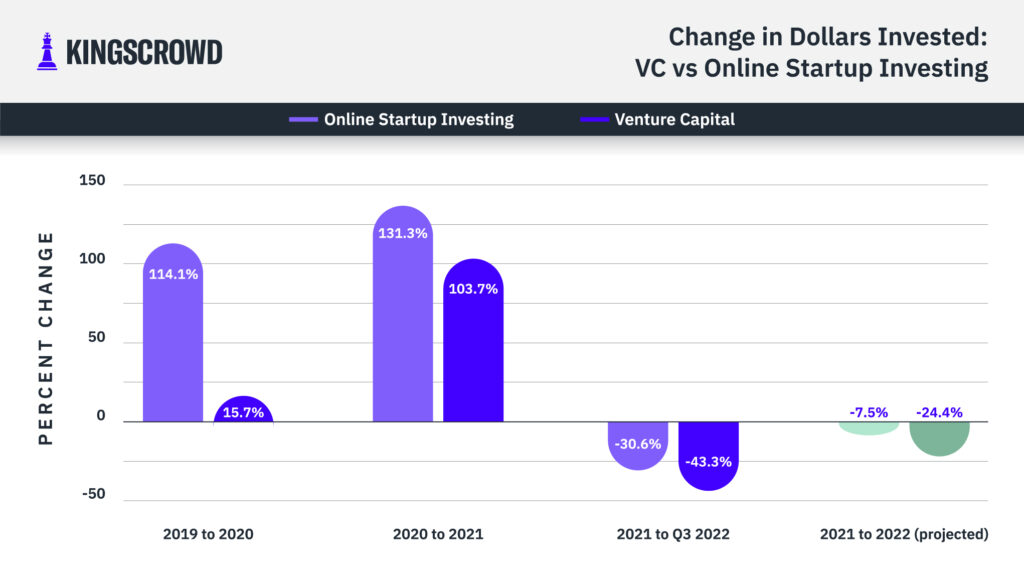

We looked at the yearly growth of dollars invested through both VC (seed and early stage deals only) and online startup investing from 2019 through the third quarter of 2022. And assuming that the rate of investments in both sectors holds steady, we projected the change from last year’s totals through the end of 2022. We found that from 2019 through 2021, online startup investing grew by more than 100% year-over-year. And while VC investments grew only modestly from 2019 to 2020, the industry also saw immense growth in 2021. However, that narrative is changing due to the economic struggles and world events of this year.

Total dollars invested is slowing in both VC and online startup investing this year. But VC is definitely pulling back more. Our projections estimate that VC dollars will drop by almost 25% this year, while online startup investing will decrease by less than 10%. While many may have said that online startup investing’s previous growth was unsustainable, the fact that it isn’t declining as quickly as VC investments points to the opposite conclusion. In fact, it looks like VC’s 2021 boom was more unsustainable than online startup investing’s more steady growth.

There could be a few reasons why VCs are investing less this year. Part of it might be less deal flow in the VC world. For example, many founders decided to prioritize profitability over growth since the latest market crash. And they’re seeking less external funding as a result. Fewer investment opportunities means less dollars invested. Meanwhile, deal flow in online startup investing has held steady throughout 2022, with an average of more than 500 active deals each month.

Another consideration is that instead of their own money, VC firms invest the funds of their limited partners (people who invest money and receive shares but aren’t deeply involved in business management). The fear of losing that money in a recession could be making VCs hesitate on deals they might have previously funded.

On the other hand, retail investors behave differently because they’re investing their own money. And they seem more confident than stock market investors this year. Seeing online startup investments go down by 7.5% this year wouldn’t be alarming at all. The online private market, VC, and stock markets all had an exceptional year in 2021. So it’s normal to see some corrections in the industry, especially alongside recession concerns. It is actually a good sign.

Retail investors can rest assured. Online startup investing has been growing quickly, and it is still a thriving market. Even if total investments are down in 2022, it won’t be too far off from last year’s total. That kind of market resilience is definitely attractive for founders who are ready to grow their startups. And that means we should keep seeing great deal opportunities in online startup investing.

Note: All data on online startup investing used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the US crowdfunding market.