It’s been a little while since the world of digital currencies has had a real blowup. After the collapse of FTX and the arrest of its founder, Sam Bankman-Fried, rattled both the financial and political systems of the United States, the scandal du jour is a nice return to familiar territory: one involving stupid memes.

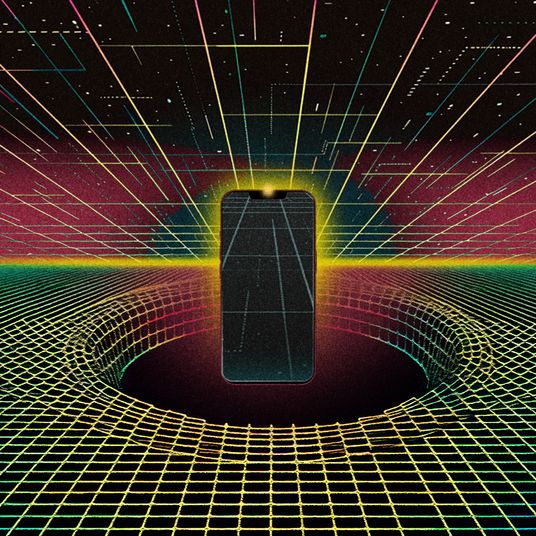

The immediate crisis is that if you want to buy or sell bitcoin right now, it is very hard to do so. The network that processes bitcoin transactions is all jammed up — at its peak, there have been more than 400,000 orders that are essentially stuck in a queue. These are all transactions that have built up over days, causing the price for conducting one to spike to about $20. (Last month, it was as low as 87 cents.) It’s not a perfect analogy (there are workarounds for bitcoin), but imagine paying for your groceries with a Visa card, but then being told you have to wait hours or days until all the transitions ahead of yours go through — and, oh yeah, there will also be a $20 fee.

But what’s funny here is that all those other people in the bitcoin queue aren’t buying groceries. They’re sending each other memes. These aren’t elevated or important memes — we’re literally talking about Pepe the Frog and SpongeBob. While the core bitcoin blockchain has long been dominated by data about transactions (account A sending account B a given amount of bitcoin currency), recent innovations have made it cheaper and faster for people to write all kinds of data into the transaction, including pictures and jokes — a process called “inscribing.” So now bitcoin is a platform for not only bitcoin transactions, but for NFTs — recall those blockchain-based images like the Bored Apes that everyone was (very) briefly excited about — and joke coins that are all basically aspiring dogecoins. Two meme-coin projects, one based on the amphibian Pepe and the other on SpongeBob, are currently enjoying a major speculative boom, both acting like it’s 2021 again. The demand is so wild that meme coins like these did $2.3 billion in volume last week. The resulting network congestion was so bad that Binance, the world’s largest crypto exchange, was forced to temporarily suspend bitcoin withdrawals.

So the big questions today — at least, among the kinds of people who spend much of their time thinking about bitcoin — are around whether this kind of innovation is a good thing or a bad thing. Was the underlying system really built for handling these kinds of transactions? Was the bitcoin blockchain meant to be inscribed with millions of stupid, fleeting jokes and memes? Or is this all fine and are the queues just a momentary growing pain as bitcoin expands into new use cases (ridiculous as they may be)? “The Bitcoin network has gradually supported more different types of tokens like NFTs. This adoption should be a positive sign longer term but it looks like it has slowed down the network,” an analyst at Oppenheimer wrote, according to CNBC, tentatively taking a position in the optimists’ camp.

This whole mess came out of an upgrade to the bitcoin system last year, which was supposed to have made transactions faster and cheaper. When bitcoins are traded, the transactions are recorded on the blockchain, the immutable ledger of who owns what that’s the founding innovation for the whole crypto economy. “It’s always been possible to inscribe data into a transaction on bitcoin. That’s nothing new,” Cory Klippsten, CEO of the financial-services firm Swan Bitcoin, told me. After last year’s upgrade made it easier to transmit data, “it wasn’t long before anyone could invent a more lightweight way to do it,” he said. The new ways to do this are bitcoin-adjacent systems called Ordinals and Stamps.

Bitcoin is, of course, the original cryptocurrency and, until now anyway, its proponents have seen it as more pure, less junky and corrupt than the rest of the crypto world. It doesn’t function like a backdoor equity offering for funding some other venture — a model that’s led to all kinds of scammy tokens, as well as a crackdown by the Securities and Exchange Commission for companies violating securities laws. Because profits from bitcoin-trading can’t feed back to some corporate source (the network was created by Satoshi Nakamoto, who mysteriously vanished afterward, and now nobody owns it or controls it), it’s regulated as a commodity — like a barrel of oil, or a bushel of wheat.

Bitcoin’s biggest cheerleaders are called Bitcoin Maxis (or maximalists). For years, they have mocked other crypto projects (a.k.a altcoins) for being unserious and scammy. Now, after the spectacular run-up in Pepe coins, they face the uncomfortable reality that the shitcoiners (as they call their foes) are have, at least temporarily, taken over their precious network.

Klippsten, himself something of a bitcoin purist, sees the rest of the crypto universe trying to borrow bitcoin’s cred. “It’s exciting to altcoiners whose whole goal is to grab some shine from bitcoin, do the bitcoin affinity thing, and then do some pump and dump with their shitcoin projects,” he said. From the outside, it sure seems like these newest meme coins are showing that the line between bitcoin and the rest of crypto was never really all that hard to begin with. Bitcoin Maxis like Klippsten don’t see it that way though. “For bitcoin, this changes nothing,” he said.